Price Change 24h

Market Cap

Circulating supply

Total Volume

All time high

All time low

24h low / 24h high

Current:

Low:

High:

Dominance chart

Fear & Greed index

Now:

Current Litecoin (LTC) exchange rate

The Litecoin exchange rate arouses much less excitement than the Bitcoin or Ethereum exchange rates. Unlike more popular cryptocurrencies, the LTC exchange rate is less exposed to speculative activity, which translates into relative price stability. In the case of Litecoin, a digital silver

, the lower popularity among investors also translates into greater utility of the cryptocurrency in transactions. Litecoin's current capitalisation is .

The current number of coins in circulation, is , and the maximum number of coins that can be in circulation is as high as . Since its inception in 2011, Litecoin has appreciated in value by . Which means that if you bought a dollar's worth of Litecoin in 2011 - 3 LTC - today you would have in your wallet!

LTC USD price during 24h period

The current Litecoin (LTC USD) exchange rate is today which means that in the last 24 hours, the LTC (Litecoin) exchange rate has changed its value by .

Price LTC PLN in 24h period

On the Polish market, Litecoin (LTC PLN) is valued at , which means that the price of Litecoin has changed by within the last 24 hours.

What is Litecoin?

Litecoin is a P2P (Peer-to-Peer) cryptocurrency, the creator took technical solutions from the source code Bitcoin (BTC), Therefore, it is easy to see many similarities between cryptocurrencies. The cryptocurrency was created in 2011 by Charlie Lee, who worked at Google at the time.

The aim of Litecoin was not to outbid Bitcoin, the creator of LTC was aware of the power and popularity of Satoshi's currency, LTC is intended to be small but secure, fast and cheap to transact.

Analogous to Bitcoin, the main principle behind the project is to decentralise and leave the power to the users - everyone is their own bank

.

How does Litecoin work?

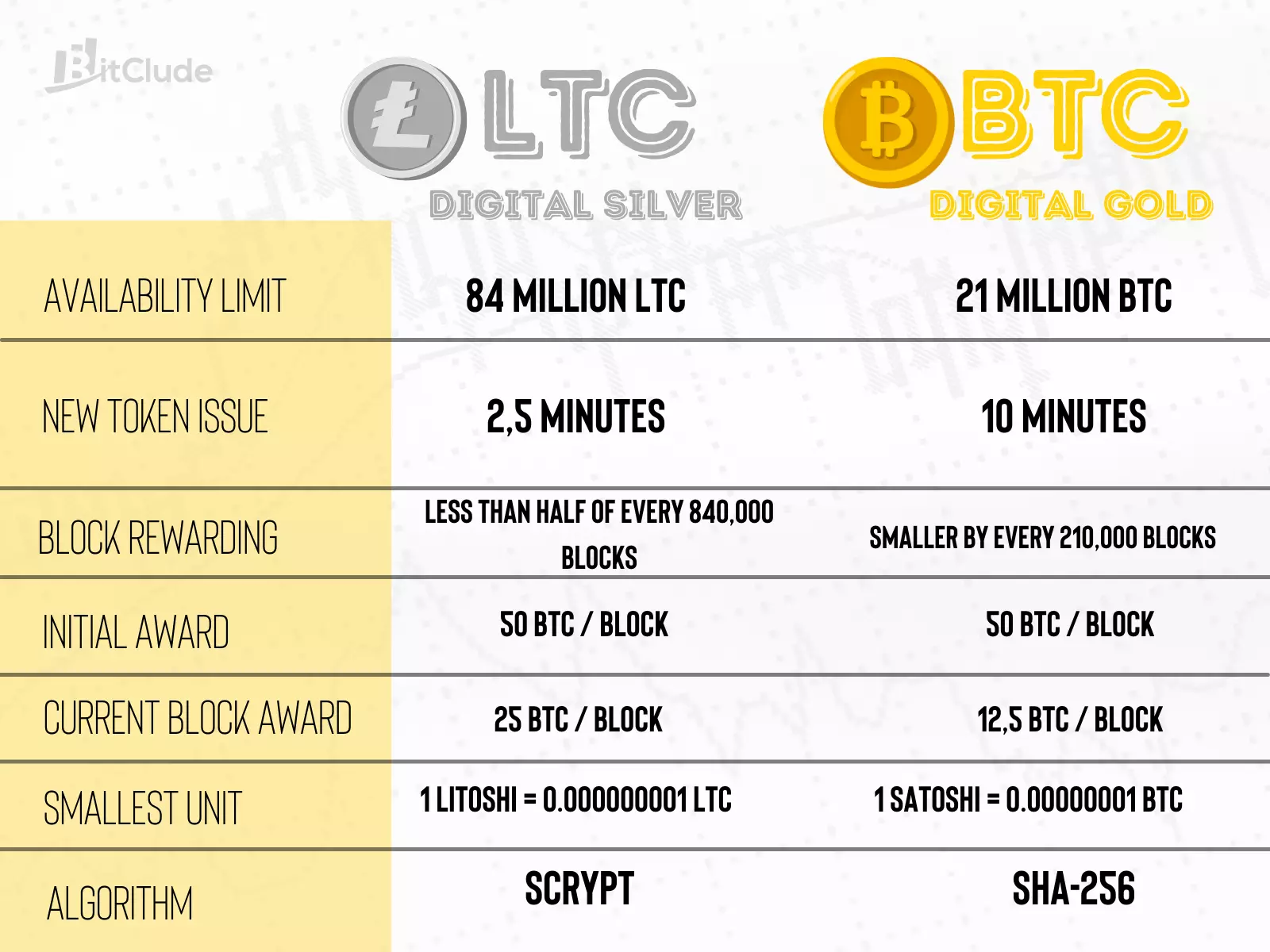

Litecoin was created as a lightweight version of Bitcoin - an improvement on it. Therefore, Charlie Lee's currency resembles BTC in many ways, although with digital silver, the team focused more on usability, easy access and speed of transactions. On the LTC network, a new block is generated every 2.5 minutes, as opposed to the average 10 minutes of BTC.

A block in the Litecoin network is verified by miners with special software, and once a block is added to the chain, that block becomes visible to all network participants. The block resembles a huge ledger in which all users' transactions are recorded - when one page (block) fills up, the records continue on the next page. All records are chronological and undisputed - just as a transaction cannot be undone, neither can a record of it be removed from the block.

Miners are paid a small commission for performing the calculations needed to confirm transactions, which then fill the block. Because of the much greater scalability of LTC relative to Bitcoin, the transaction does not increase as dramatically when the network is under load.

How to mine Litecoin?

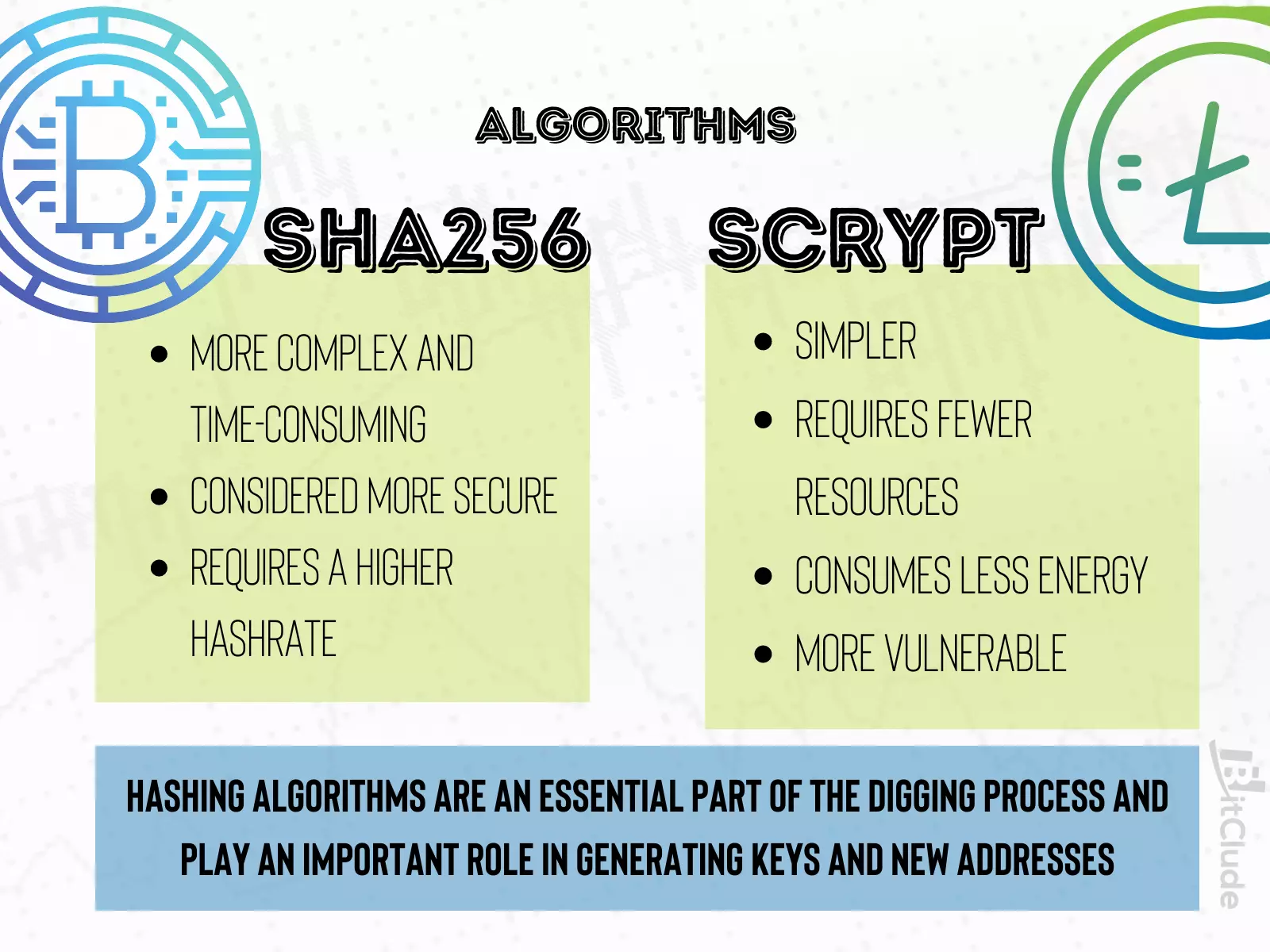

Charlie Lee wanted easy access to Litecoin, so he used a different algorithm than Satoshi. Litecoin uses the newer Scrypt algorithm, while BTC uses the much more complex SHA-256. The difference in algorithms used translates significantly into digging (or the difficulty of digging).

While BTC miners have to perform very complex and resource-intensive operations to confirm transactions and dig up a new block (for which they use dedicated hardware - ASICs), LTC miners have lower computing power requirements, so that they can use the processors (CPUs) and graphics cards (GPUs) of personal computers to dig.

Lower computational difficulty carries with it a lower level of security. Scrypt also simpler than SHA-256, but despite this, there is still no reported breakage of the algorithm behind Litecoin. There has also been no documented successful attempt to reverse engineer the algorithm to break it.

Who created Litecoin?

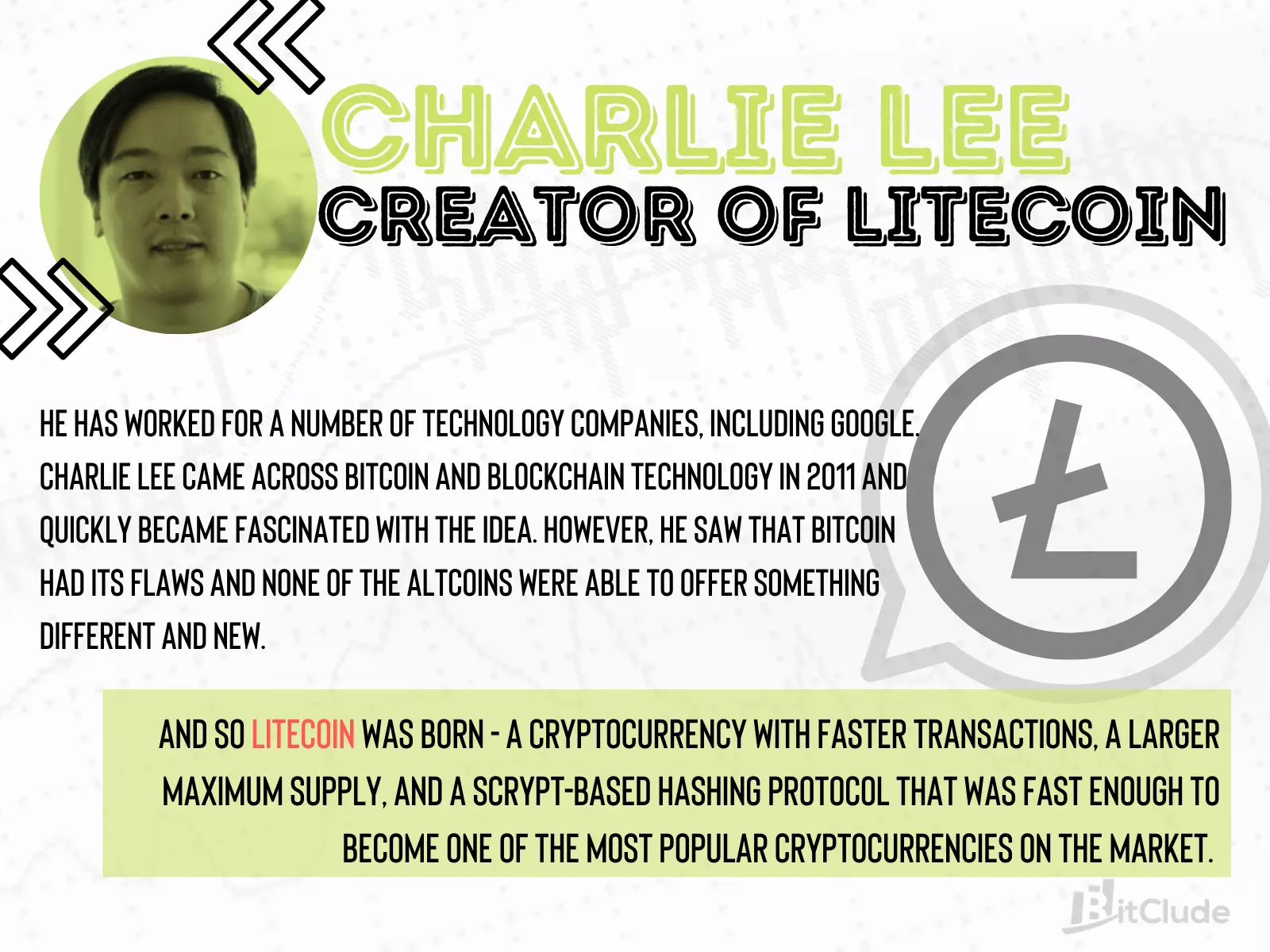

Litecoin was created by a team of developers led by Charlie Lee. The LTC we know was not Charlie's first approach to creating a cryptocurrency - in 2011 Lee created Fairbix, a currency that was a combination of the existing Bitcoin and Tenebrix. Unfortunately, the first project was not as successful and due to code bugs, a 51% vulnerability and the fact that the entire currency was pre-mined (mined early), Fairbrix collapsed while laying the groundwork for Litecoin.

Just a few weeks after the failed project, Lee unveiled LTC - a currency that clearly improved Bitcoin in many ways, although it was not created as its competition - after all, it was intended to become digital silver - a currency capable of making quick and smaller transfers, when BTC was to remain for large and international transactions.

Who is Charlie Lee?

Charlie Lee is an MIT graduate, having graduated in 2000. From the beginning of his career, lee was fascinated by computers and the digital world, and was a talented developer. In the early 2000s he worked at top technology companies such as Google and Guidewire Software.

During his employment at Google, Mr Lee has worked on projects such as the Youtube mobile app and Chrome OS, among others. While working at Google, Charlie learned what Bitcoin was and it proved to be a turning point in his career. BTC aligned with his economic worldview on many points, which translated into a quick fascination with the new solution. Charlie quickly adopted BTC and began experimenting with mining it. Absorbed in his fascination, he began to develop the idea of cryptocurrencies on his own, trying to create his own cryptocurrency.

Since Litecoin's launch, Charlie has worked at Coinbase - a cryptocurrency exchange that still exists today. In 2017, he decided to leave the company to focus more on LTC. A year later - in 2018 - there were rumours that Charlie was going to leave Litecoin because his presence and influence on the currency prevented it from being fully decentralised, but despite the creator himself confirming these rumours, he has not yet decided to leave his project.

What is the supply of Litecoin?

The supply of LTC has been top-down at 84,000,000. Currently, there are 66,752,415 cryptocurrency units available for trading. Which means that almost 80% of this cryptocurrency has already been dug up. Fortunately, as with BTC, the solution to approaching the upper supply limit is cyclical halving.

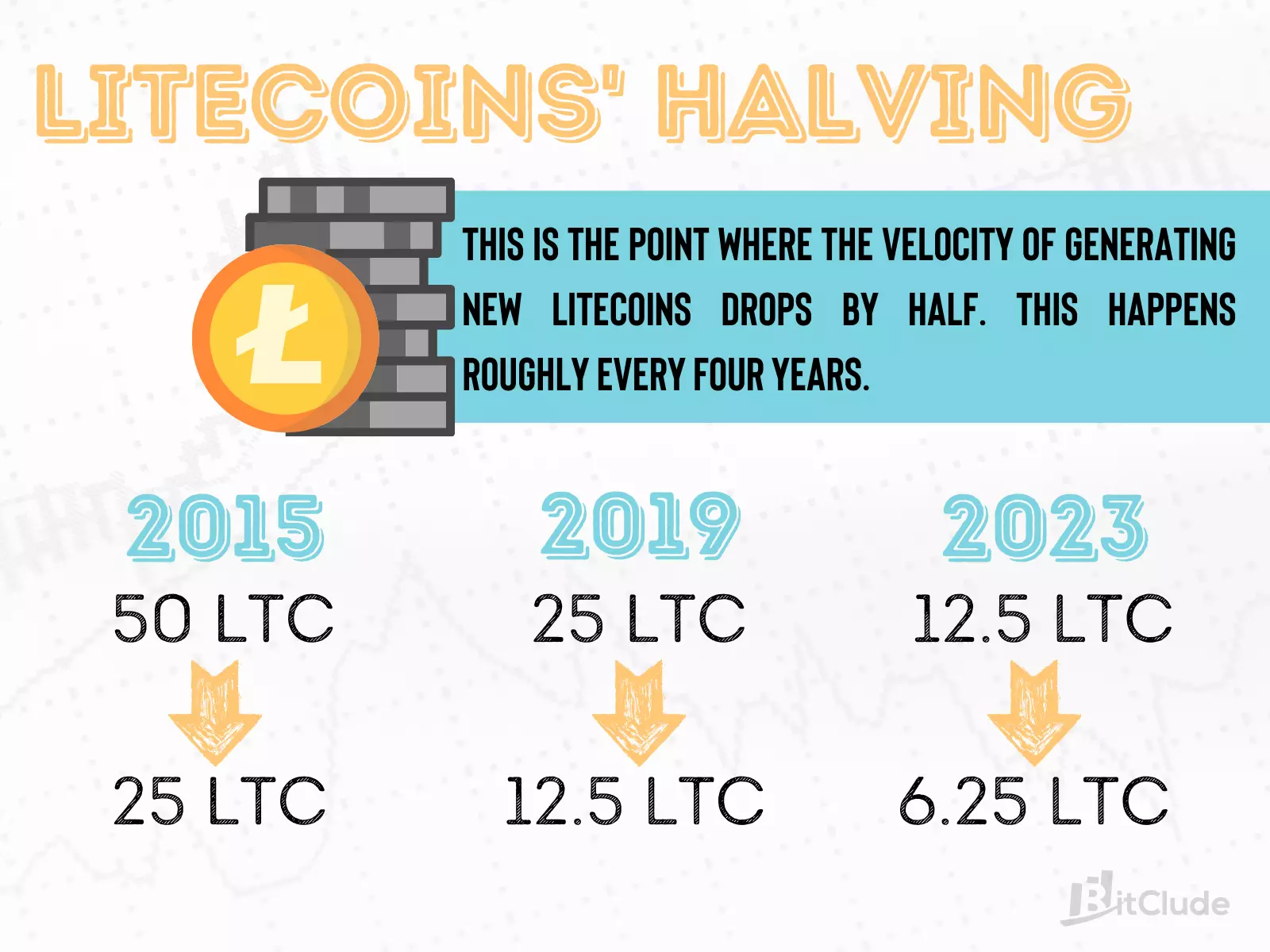

Halving Litecoin

New Litecoins go into the pockets of miners as a reward for digging a new block. A miner, for enough work-power can receive a certain amount of Litecoin. In the case of Litecoin, halving is more common, as it takes only 2.5 minutes to dig up one block, while in the case of Bitcoin it is as much as 10 minutes. Initially, the value of the reward was as much as 50 LTC, which translated into a daily mining of 28,800 LTC!

As the name suggests - halving reduces the reward by half. Which means that on the first halving, the reward was reduced from 50 LTC to 25 LTC. The date of the first halving was October 25, 2015. According to the halving rule, the daily extraction then dropped from 28,800 to 14,400 LTC.

The last Litecoin halving so far took place on October 5, 2019, at which time the reward dropped to 12.5 LTC and the daily output to 7200 LTC. The next halving will take place in about 2 years, you can check the countdown to that event here.

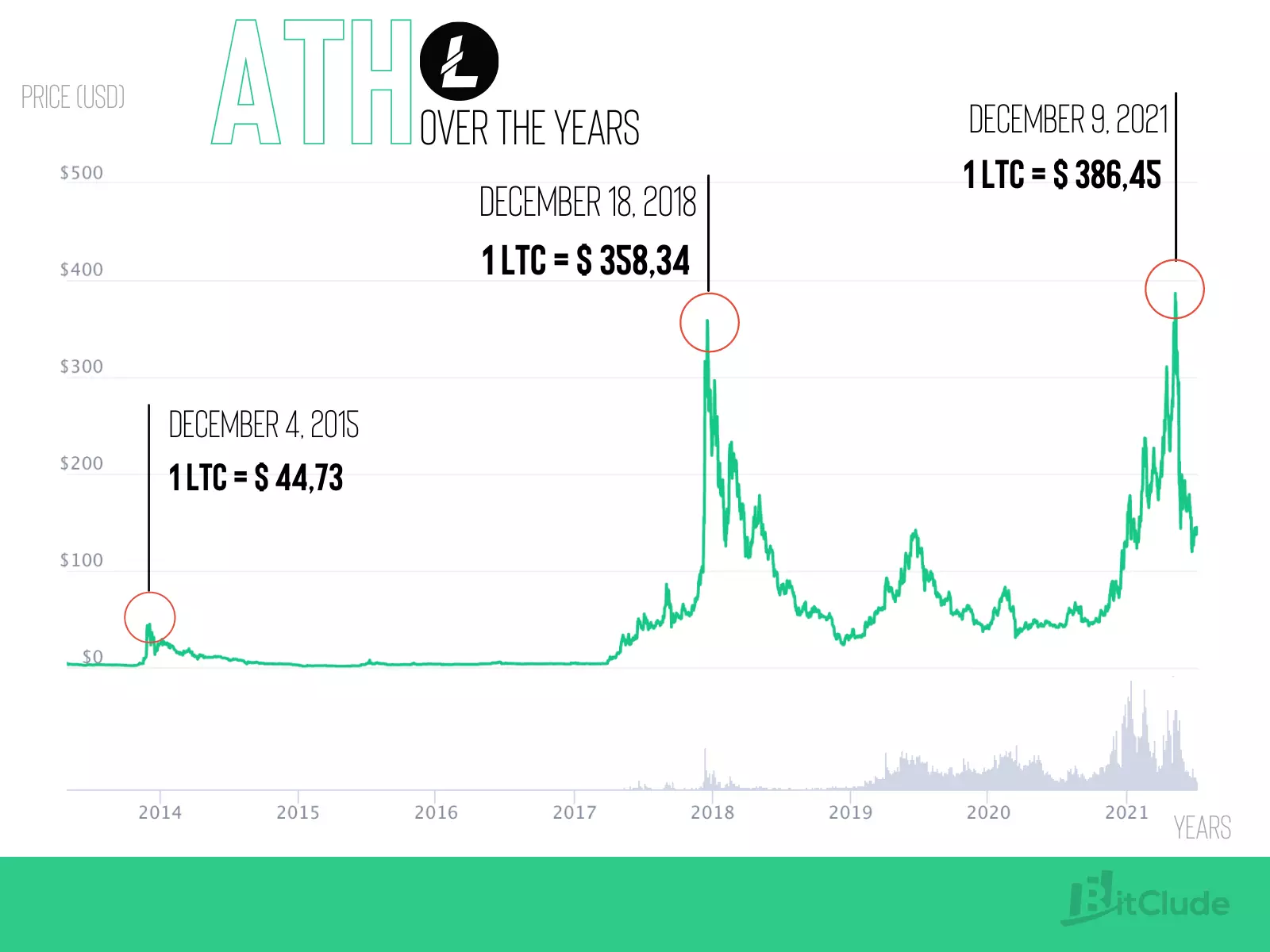

The impact of halving on the Litecoin exchange rate

As the reward is split in half, the supply of Litecoin is reduced, which positively affects its price. The reduction in new Litecoin inflows causes miners to want to sell their Litecoins at a higher price to offset the cryptocurrency's fishing effect and return to previous profitability.

A side effect of this phenomenon, is the sudden drop in computing power present in the Litecoin network. The decrease in reward results in a decrease in the profitability of mining, as miners look for more profitable cryptocurrencies to dig. Conversely, after the decrease in computational difficulty that comes with the decrease in the number of miners present, some miners decide to return.

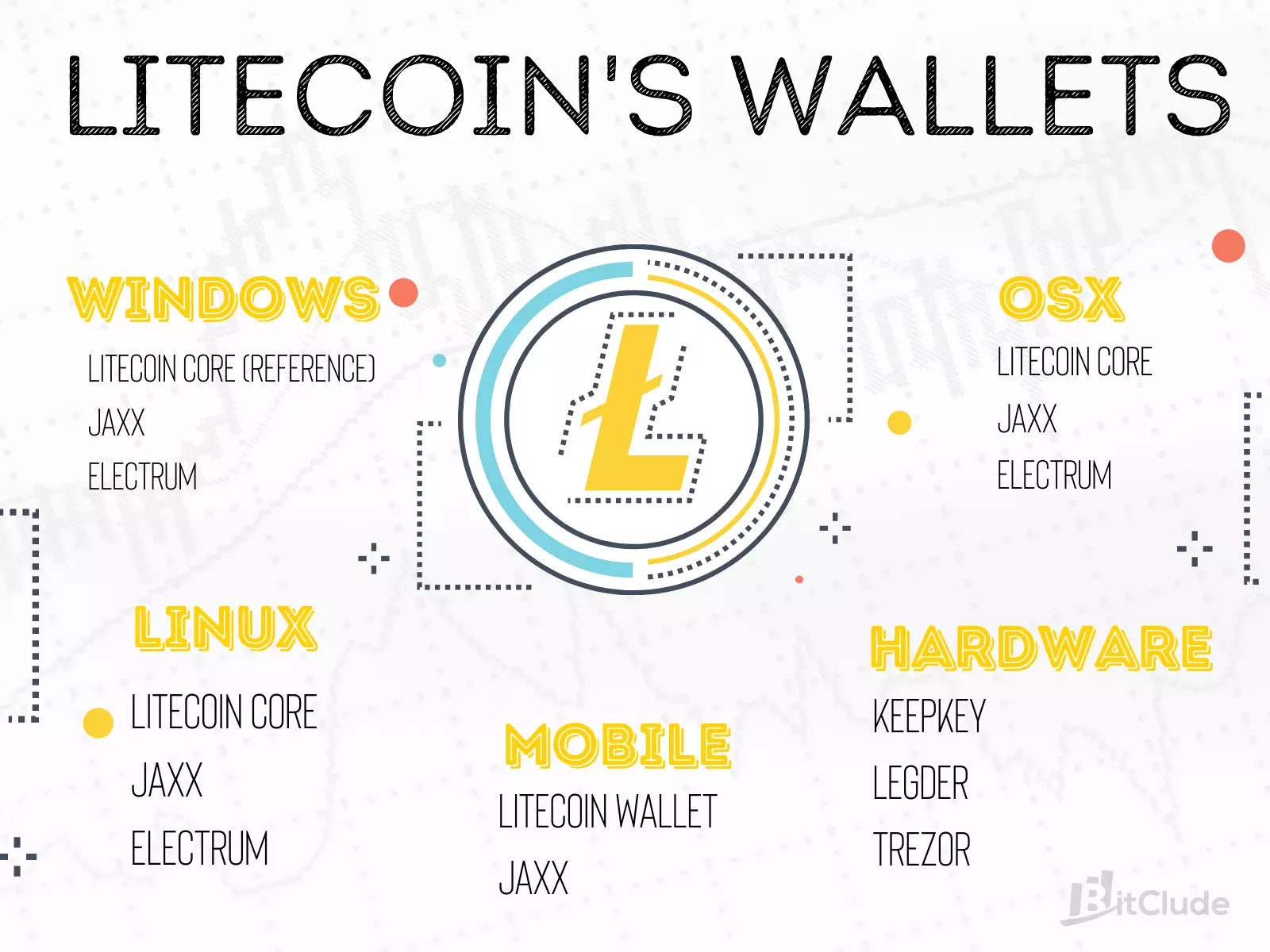

Litecoin wallet - Which wallet to choose?

Cryptocurrencies, unlike physical money, cannot be stored in a trouser pocket. To store cryptocurrencies, there are two basic types of wallets - cold wallets and hot wallets. The main difference between the portfolios is the fact that they are constantly connected to the network, or not.

Hot Litecoin wallet

A hot wallet is characterised by a continuous connection to the network. This feature is at once the greatest strength and weakness of this type of wallet. The wallet is available in a browser or in a mobile application, allowing access from any place in the world where the Internet is available. This type of wallet also allows instant access to funds, thanks to which it is possible to execute buy/sell actions on the stock exchange within a few minutes.

A website that will allow you to store LTC and trade can be either an exchange or a dedicated online wallet - it all depends on how you intend to use your funds. A trader who is constantly exchanging digital currencies will certainly opt for an exchange to save the time and resources needed to perform fund transfers.

Where does the downside lie? Being constantly connected to the network creates a vulnerability to attack, or paralysis of funds. Therefore, before choosing the application where you decide to store your funds, it is worth doing a little research to see where your funds will be safest.

The official Litecoin wallet, is Litecoin Core. The project is backed by the developers and qualifies as a full wallet, meaning it stores the entire blockchain in memory, which requires a longer time to sync the wallet with the network.

What if I want to keep my money in the proverbial piggy bank?

Litecoin cold wallet

A cold wallet is the option of choice for long-term cryptocurrency growers, but also for those who value the highest level of security for their portfolio. In opposition to hot wallets, which are constantly online, cold wallets stay offline by default - they are online only at the moment when the user wants to transfer funds to an exchange or to another user.

The most popular among cold wallets are Ledger and Trezor - advanced devices that look like a flash drive. Each of these devices operates on advanced software that provides the highest level of security for each cryptocurrency.

What is the downside of cold wallets?

Their biggest problem is the fact that you have to remember about them. If you lose access to the device, you lose access to your funds (but it is possible to recover these funds thanks to specially generated seeds). Another disadvantage is that the funds are outside the exchange and it is not possible to make an immediate buy/sell operation, which decreases the mobility of our currencies.

Among cold wallets there is also an archaic solution, which is storing funds

, or actually data that allow access to the funds, on a piece of paper. The solution is very clumsy, but it opens the possibility of giving LTC or BTC under the Christmas tree, in the form of a piece of paper.

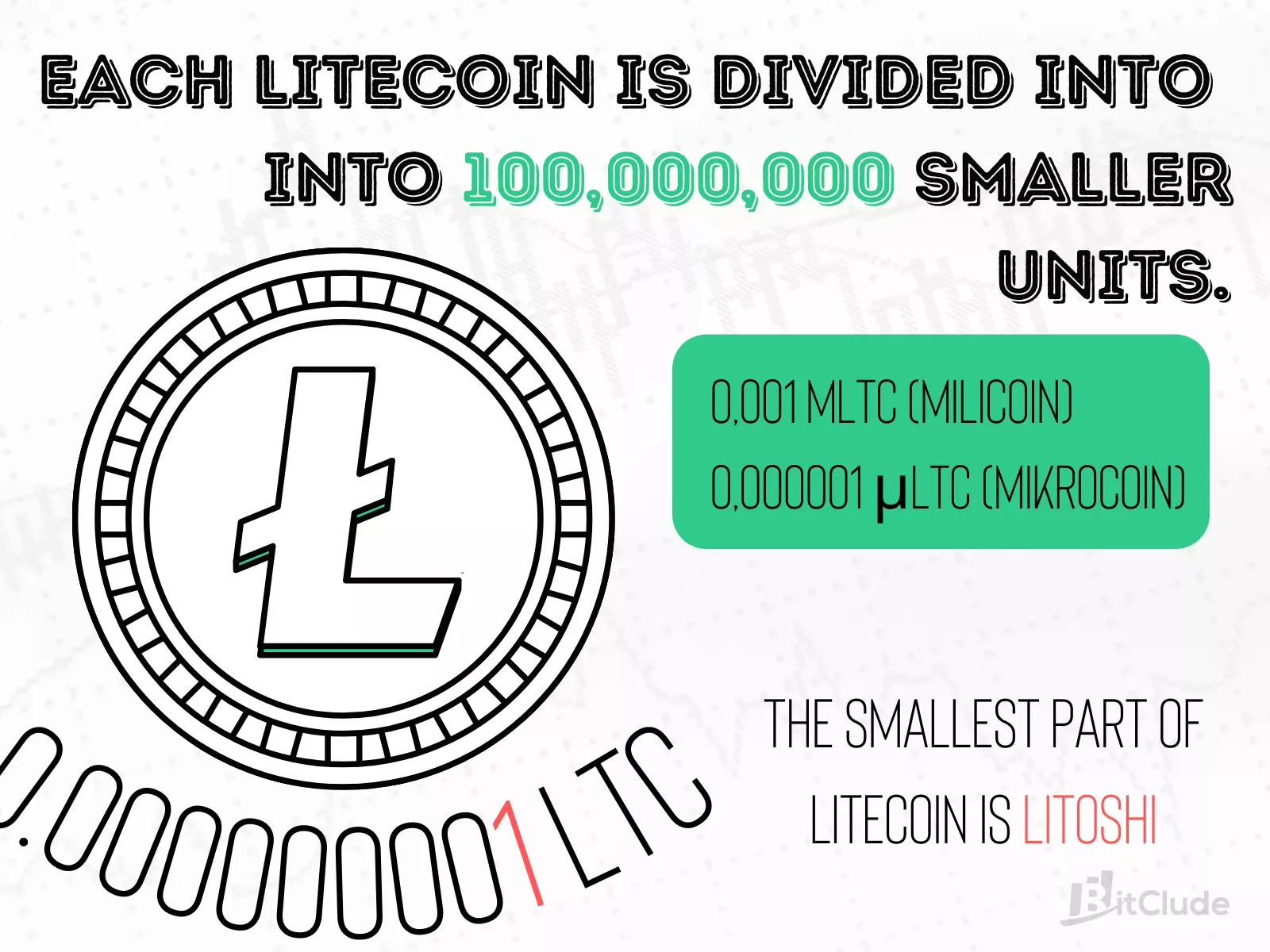

Do You Have to Buy All of the Litecoin?

The smallest part of Litecoin is Litoshi, or 1/100,000,000 LTC (0.00000001 LTC). In contrast, the smallest part of LTC that can be bought is currently 0.01 LTC - although this amount is strongly dependent on the exchange and the current price of Litecoin in the market.

Is it Safe to Invest in Litecoin?

Litecoin is presented as digital silver, even in this article I happened to use this comparison a few times. However, unlike investing in bullion, investing in cryptocurrencies is much riskier, and as a result, the return on investment can also be much higher.

Litecoin has been on the market since 2011 and is capitalised at . Despite dense competition and a flood of younger projects, Litecoin is still a widely used cryptocurrency. Unlike BTC, its ability to perform transactions is invaluable. On the other hand, despite its great utility, the exchange volume of this cryptocurrency is usually relatively low, which is clearly visible in its price.

Last ATH LTC was .

Is Litecoin better than Bitcoin?

Litecoin is seen as Bitcoin's little brother - it wasn't created as a competitor, just a complement. When Bitcoin was supposed to take care of large transactions, the target for LTC was e-commerce and smaller payments. Litecoin's undoubted advantage is much faster and cheaper transfers, so while Bitcoin is clogging

up, Litecoin's exchange volume and capitalisation is skyrocketing - all through demand for fast payments.

Despite the theoretically weaker security with the Scrypt algorithm, there has not yet been a reported case of it being broken. This means that the simpler and less resource-intensive algorithm is currently quite sufficient.

Litecoin will never catch up with the price of BTC, many factors contribute to this, including the lower popularity of its younger brother, less interest from corporations as well as ordinary investors. Litecoin will forever remain a useful peer to peer cryptocurrency whose usage and exchange volume will increase when Bitcoin slows down a bit.

By knowing Litecoin's history and how it works, you are one step closer to making an informed investment decision. Remember that cryptocurrency transactions take time to to learn about market realities and obtain information on the characteristics of each currency in which you intend to invest.

If you want to buy Litecoin, you don't have to look any further for the right place - the Egera exchange is the place to buy your cryptocurrencies in no time. The simple interface allows even less experienced users to register and buy in just 3 minutes! Try it out today and join the thousands of users who trust us.

Cryptocurrency Ranking:

Back to the ratesStart your trading journey right here!

...or just keep calculating prices

Table of Contents