What is Bitcoin?

Transactions in the Bitcoin network are independent. No bank account is required to purchase and store Bitcoin. Online transactions are unblockable and irreversible by any entities and organizations.

Fast international payments - transaction between Europe and Africa takes 10 minutes. Banks and other institutions do not participate in the process.

Privacy protection - measures used in the network may be anonymous under appropriate rules.

Security and Protection - Bitcoin transactions are institution and government independent and mathematically protected.

-

Decentralized P2P network

A decentralised exchange (DEX) is a type of exchange that, according to the philosophy of cryptocurrencies, is without a central entity. Transactions on such an exchange are carried out directly between users, i.e. in a peer-to-peer (P2P) model. Decentralisation helps to maintain the integrity of the exchange and prevents trade rigging and price manipulation.

-

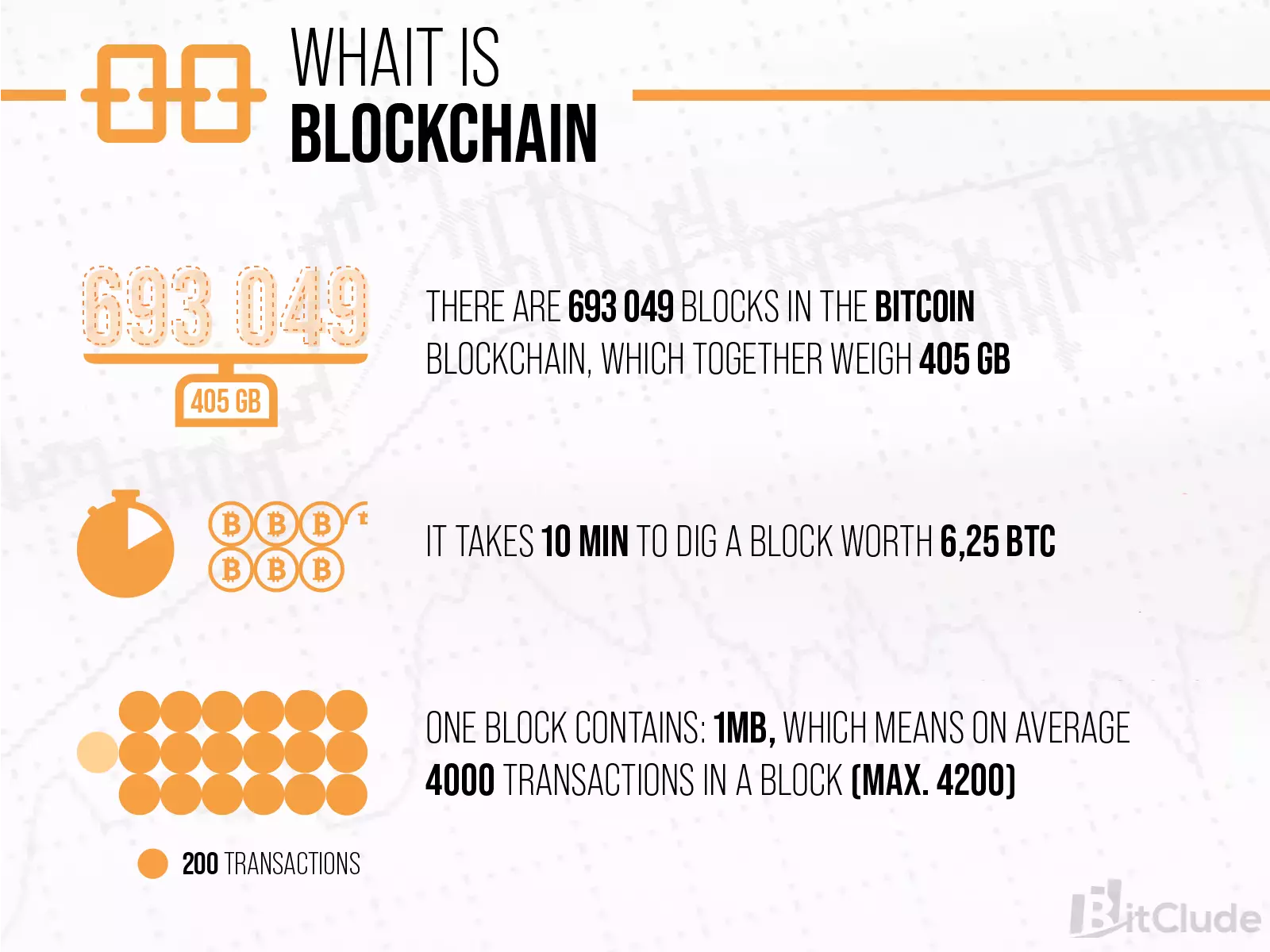

Blockchain technology

Blockchain is the technology behind Bitcoin. Blockchain can be likened to a big accounting system that contains information about transactions.

-

Transactions and miners

The blocks contained in the chains are created by miners, and digging - creating a block takes approximately 10 minutes. The blocks contain confirmations and transactional data - when one is full, the next is created - together to form a chain.

- Bitcoin is a cryptocurrency that was created in 2009 and is a decentralized form of digital currency, meaning it is not controlled by banks, governments, or centralized institutions.

- Bitcoin transactions are recorded in the blockchain, i.e. a public transaction register, confirmed and monitored by many nodes (i.e. users) around the world.

- Bitcoin mining, also known as mining, is a process where users use the computing power of their computers or ASICs to solve complex mathematical problems to process transactions.

- Bitcoin can be used to buy goods and services and as a form of investment, but due to its high volatility, investing in Bitcoin can be risky.

You may know more or less what bitcoin is, but you want to better understand what its phenomenon is all about. Cryptocurrencies, of which bitcoin is the most popular, have made a huge impact on the financial market and have helped many companies and individuals make a small fortune. What is bitcoin and what are cryptocurrencies in general, and how can you make money with them? Why is the value of one bitcoin growing so fast and who is Satoshi Nakamoto? What is the bitcoin network? Read our article and you will successfully enter the world of cryptocurrencies - just like other users before you.

Cryptocurrencies are becoming increasingly popular. Cryptocurrencies can be described as virtual money, as they can be used to make payments for various services or goods. Such payments, e.g. with bitcoin, are only possible when the seller accepts this form of payment. Cryptocurrencies do not have a physical form, but have their own value. Cryptocurrencies do not have a physical form, but they do have a value, which makes it possible to make transactions with them. Cryptocurrency wallets are used to store virtual money.

What is blockchain-based blockchain technology?

To understand what bitcoin is all about, it's good to know what blockchain - or blockchain - is. Think of this technology as a digital ledger, which is a record of transactions made on the internet. Information about individual transactions is arranged in consecutive blocks of data.

Each block contains information about a certain number of transactions, so eventually something like a blockchain is created. Thanks to cryptographic tools, blockchain has a high level of security - At the same time, it is open to anyone and protected from unauthorised access. The smooth functioning of the technology is made possible by its enormous computing power, while the list of transactions on the blockchain allows secure payments and reduces risk to a minimum.

It is the creation of new blocks - the owner of the computer (eng. Node) receives a benefit in the form of units of a given cryptocurrency. This process is commonly called mining, or even digging cryptocurrency. Even the use of a single computer gives the possibility of digging out virtual money.

What is bitcoin?

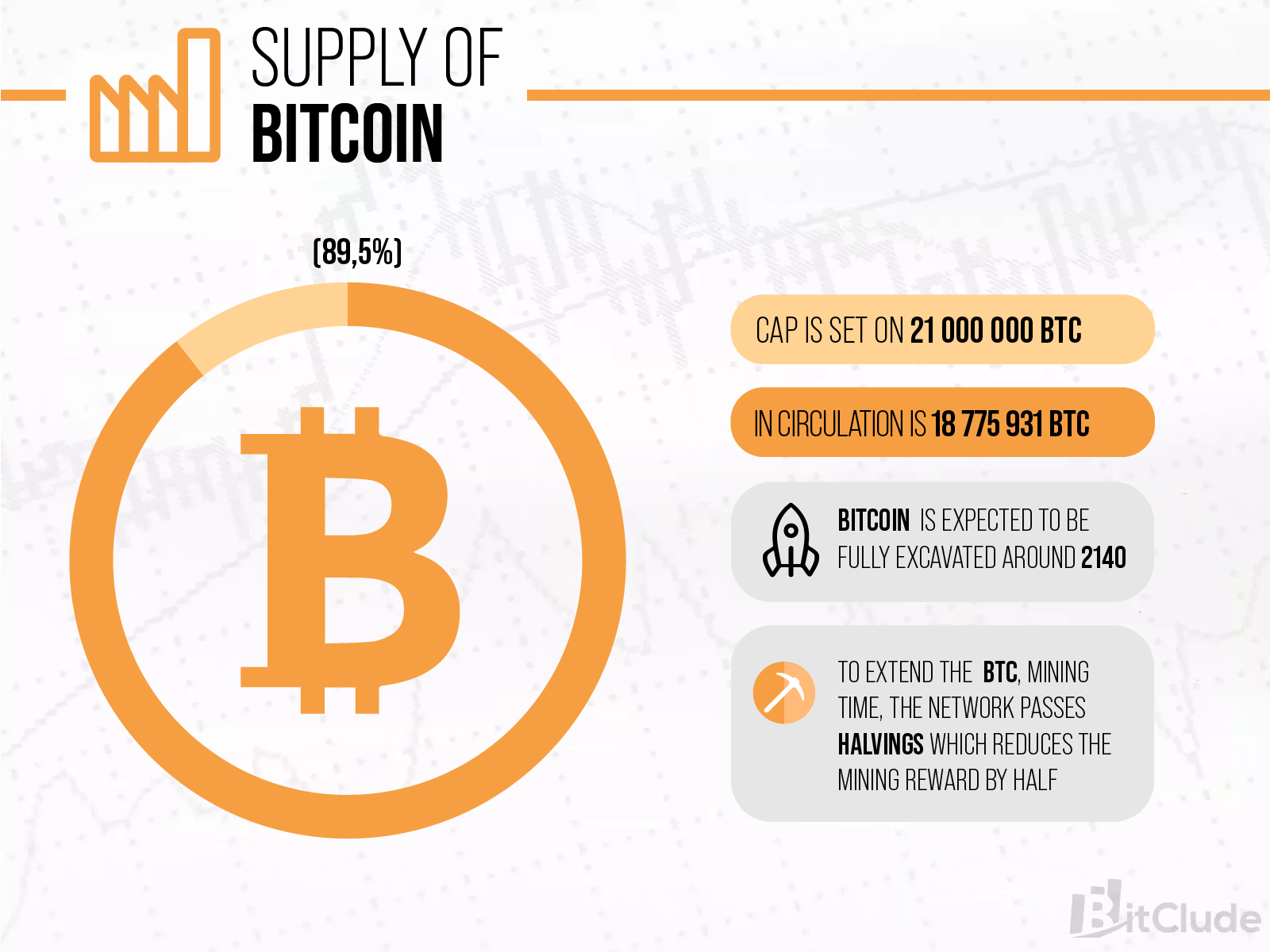

Wondering what bitcoin is? Bitcoin is a cryptocurrency that, since 2008, has allowed online users to transfer digital money, thereby completing a series of transactions. The creator of bitcoin is Satoshi Nakamoto (a pseudonym), and his idea was to securely transfer digital money from person to person (peer to peer) without intermediaries such as a bank, government or other external institutions. It is thanks in part to this that the value of bitcoin continues to rise, although the number of bitcoins will not exceed 21 million. Bitcoin is also very often referred to as digital gold and hides under the acronym BTC (now you are sure what BTC means).

How Bitcoin works?

Each bitcoin transaction (purchase of one bitcoin) is recorded on a so-called blockchain, which only resembles a bank register - each block contains information on the date, time and amount of the transaction. This register is not maintained by any external institution or server - it is managed by a network of decentralised computers. Their high computing power is used to create new blocks (this answers the question of what is bitcoin digging

Bitcoin digging.

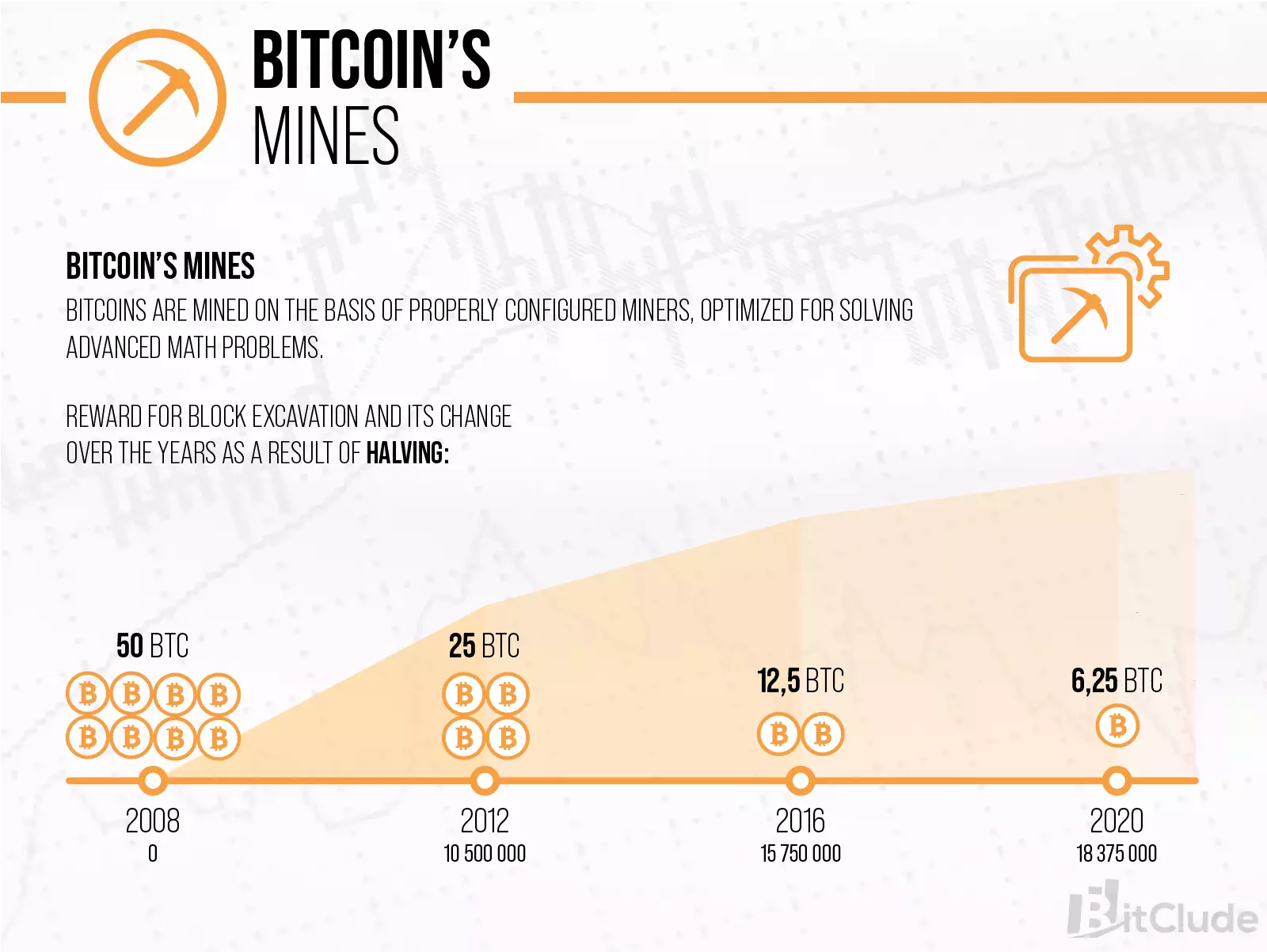

Since the very beginning of Bitcoin's creation, its target quantity of 21 million BTC in circulation has been known. Once the network has generated 21 million BTC, it will stop generating more. Bitcoins are mined based on the operation of properly configured excavators, optimised to solve advanced mathematical problems.

A person who wants to mine bitcoins must have a powerful computing unit to become a viable and efficient node of the bitcoin network. Apart from this, a bitcoin miner, should have a wallet application installed. It is in the full wallet that he has access to the entire blockchain, i.e. the transaction records placed in the dug blocks.

Bitcoin miners.

In order to increase the efficiency of mining - to increase the Hashrate, advanced devices optimised for the execution of specific algorithms are used. These are cryptocurrency miners, or ASICs. These devices are used to solve specific mathematical tasks (SHA-256). The performance of cryptocurrency miners is measured in hashes per second (Hash/s).

At the moment, digging bitcoin on your own is difficult and unprofitable. Therefore, mining pools were created, which unite people who mine bitcoin. Group mining is intended to increase computing power and thus increase the possibility of obtaining cryptocurrency. It is also a form of protection when the value of bitcoin falls. When the value of a cryptocurrency falls, people who mine alone usually abandon further mining as it becomes unprofitable.

What is the block reward?

Bitcoin mining is associated with the term block reward. This is the amount of cryptocurrency that the owner of the node providing the computing power receives for each new block created in the blockchain network. The block reward is visible in the bitcoin wallet.

Security of bitcoin currency value - or what is bitcoin halving?

As the amount of this cryptocurrency is limited, it is considered to be an exhaustible resource. The risk of a decline in the value of this cryptocurrency is then reduced. Another factor affecting the limitation of bitcoin's availability is halving. The principle of bitcoin halving is a mechanism that reduces the reward for mining a new block by half. Halving bitcoin is a phenomenon that occurs approximately every four years.

Halving bitcoin in practice?

Halving is a highly anticipated event for the whole community. So far, in quick succession Since Bitcoin's halving, there have been new records of the cryptocurrency's value. In practice, the direct consequence of halving is a decrease in computing power on the Bitcoin network, due to a drastic reduction in reward - by half.

In this situation, many miners simply abandon further mining because it is simply not profitable for them. The computing power then decreases and the difficulty of mining further blocks decreases, resulting in increased rewards for the remaining miners in the network. The remaining miners, in order to make up for the loss of reward caused by the decrease in reward, raise demands for more money for the newly acquired bitcoins, causing their price to rise.

Raising the price causes profitability to rise again and attracts miners who chose to leave Bitcoin immediately after the halving.

This cycle takes roughly 4 years - from halving, to halving. The most interesting issue with Bitcoin mining, is the answer to the question - what will happen when all Bitcoins are mined - and that could happen as early as

2140!

Bitcoin's strengths and weaknesses.

Bitcoin (BTC) is digital money that cannot be manipulated in any way and its value cannot be inflated. A cryptocurrency investor can buy just a fraction of a bitcoin and then make money with it on a cryptocurrency exchange. Many other cryptocurrencies have been created since the advent of bitcoin (BTC), but it is bitcoin that has the greatest financial and market potential.

The lack of intermediaries - governments, financial institutions, banks - means that as an investor you have much more control over your funds, which are transferred much faster. Bitcoin is fully legal and can be used to pay for services, travel or charitable donations.

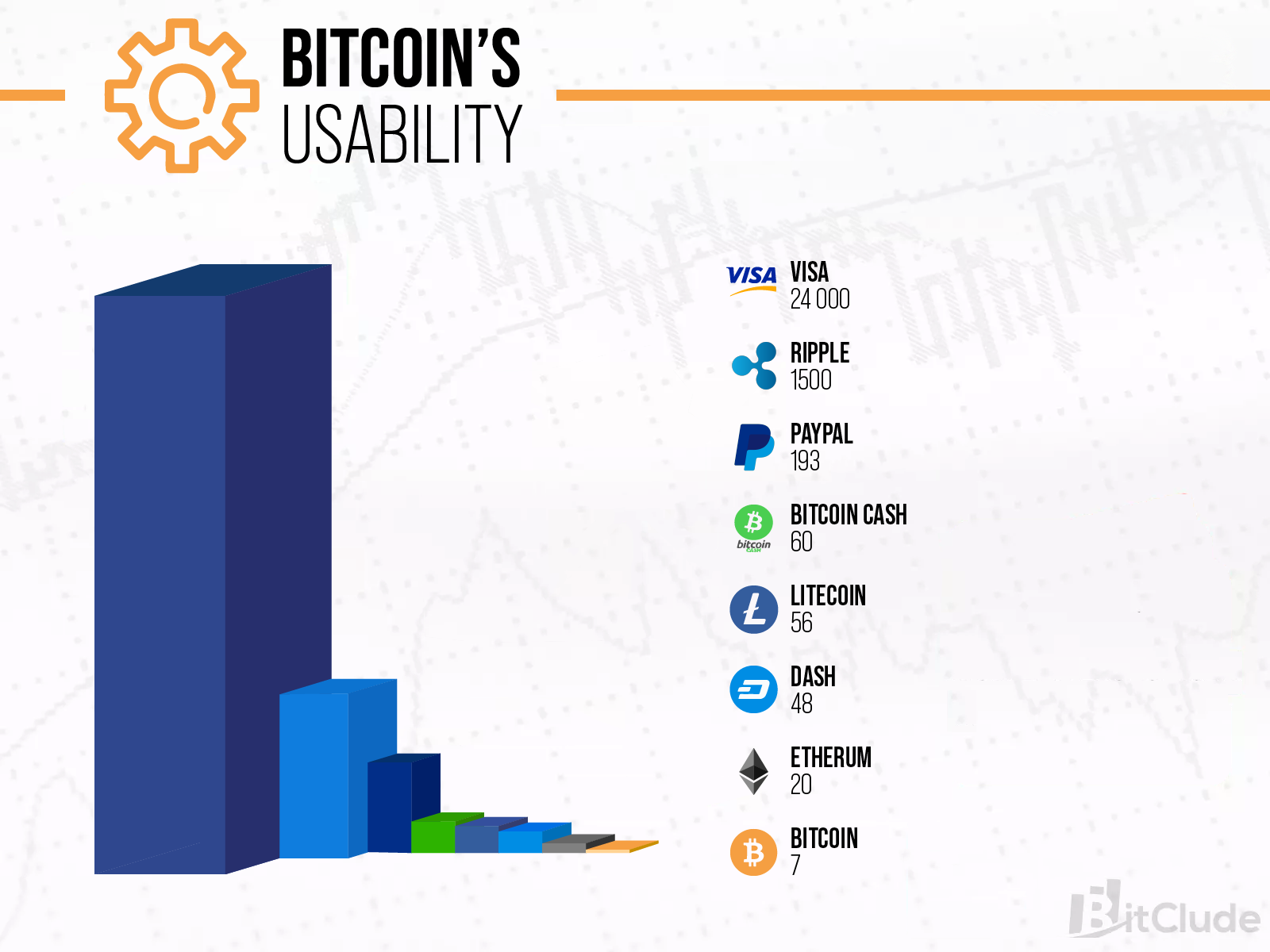

How does bitcoin perform against Ripple in terms of payments?

Bitcoin handles 7 transactions per second, while Ripple boasts a seemingly dizzying 1500 transactions during one second!

Why is this only seemingly a lot

?

While Ripple manages 1500 tps (transactions per second), Visa handles as many as 65,000 transactions during just one second!

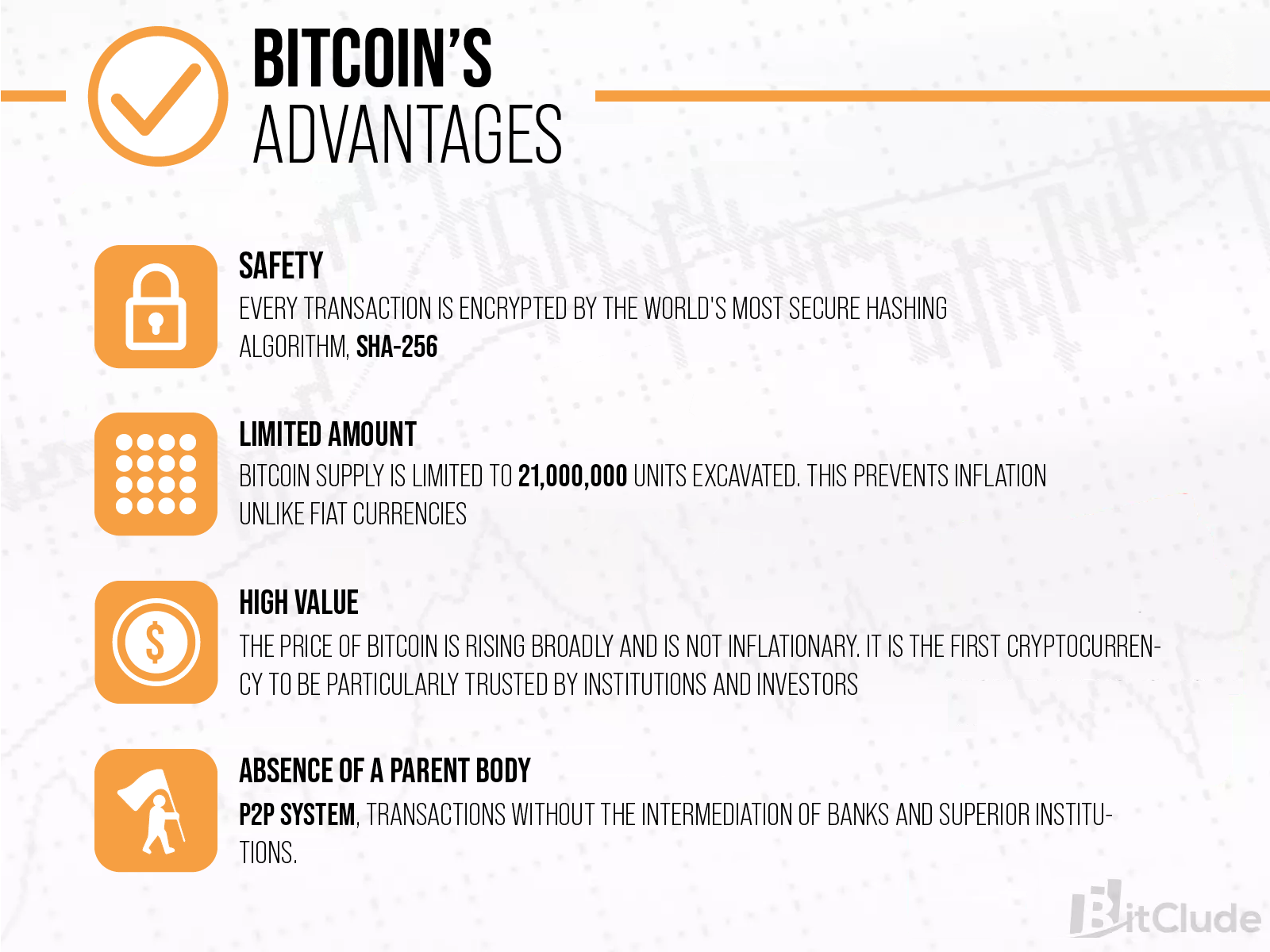

Bitcoin's advantages:

- Speed of transactions: Payments with bitcoin are made over the internet network. Transactions from even the most remote places in the world are approved every 10 minutes;

- Security: Every transaction made with bitcoin is encrypted by the SHA-256 mixing algorithm, which is the most secure in the world;

- Availability: Transactions can be made 24 hours a day, regardless of the day of the week;

- No intermediation: P2P system, i.e. transactions without the intermediation of banks and parent institutions;

- Anonymity: the virtual money owner is not required to have a bank account. Payments are made from a bitcoin wallet. Setting up a wallet does not require filling out a data form, as is the case with traditional bank accounts, which means that in the Bitcoin network we can remain anonymous;

- Decentralisation: In the Bitcoin network there is no overarching organisation that can stop or permanently block a transaction, the network is based on independent nodes that independently confirm transactions. In blockchain, each user is his own bank;

- Limited quantity: the maximum supply of Bitcoin is limited to 21,000,000 dug units of the currency. This unique feature has a very positive effect on the Bitcoin exchange rate and, unlike fiat currencies, prevents inflation;

- High value: Bitcoin is perceived as a store of value because its price has been increasing in a broad perspective (despite drastic corrections) and is not subject to the phenomenon of inflation. As the first cryptocurrency, it is endowed with special trust from institutions and investors, which is positively reflected in the prognosis of its price.

Wady Bitcoina:

- Anonymity: is both an advantage and a disadvantage of bitcoin - for governments, anonymity in the trading of funds is a huge problem as it can enable illegal behaviour by citizens. However, it is worth remembering that transactions in bitcoin (despite the apparent anonymity) are traceable!

- Lack of immunity to quantum computer computing: Bitcoin, unlike newer generations of cryptocurrencies, is in theory vulnerable to the malicious use of quantum computers. This has to do with the 51% attack theory, which occurs when 51% of bitcoin's network is taken over. In addition to taking over the network, quantum computers were also supposed to have enough computing power to crack the SHA-256 mixing algorithm, which could lead to private keys based on address and public keys. In contrast, none of these concerns are currently valid, as quantum computers have a different specificity for solving tasks than computing units focused on executing a single algorithm (e.g. application-specific integrated circuit).

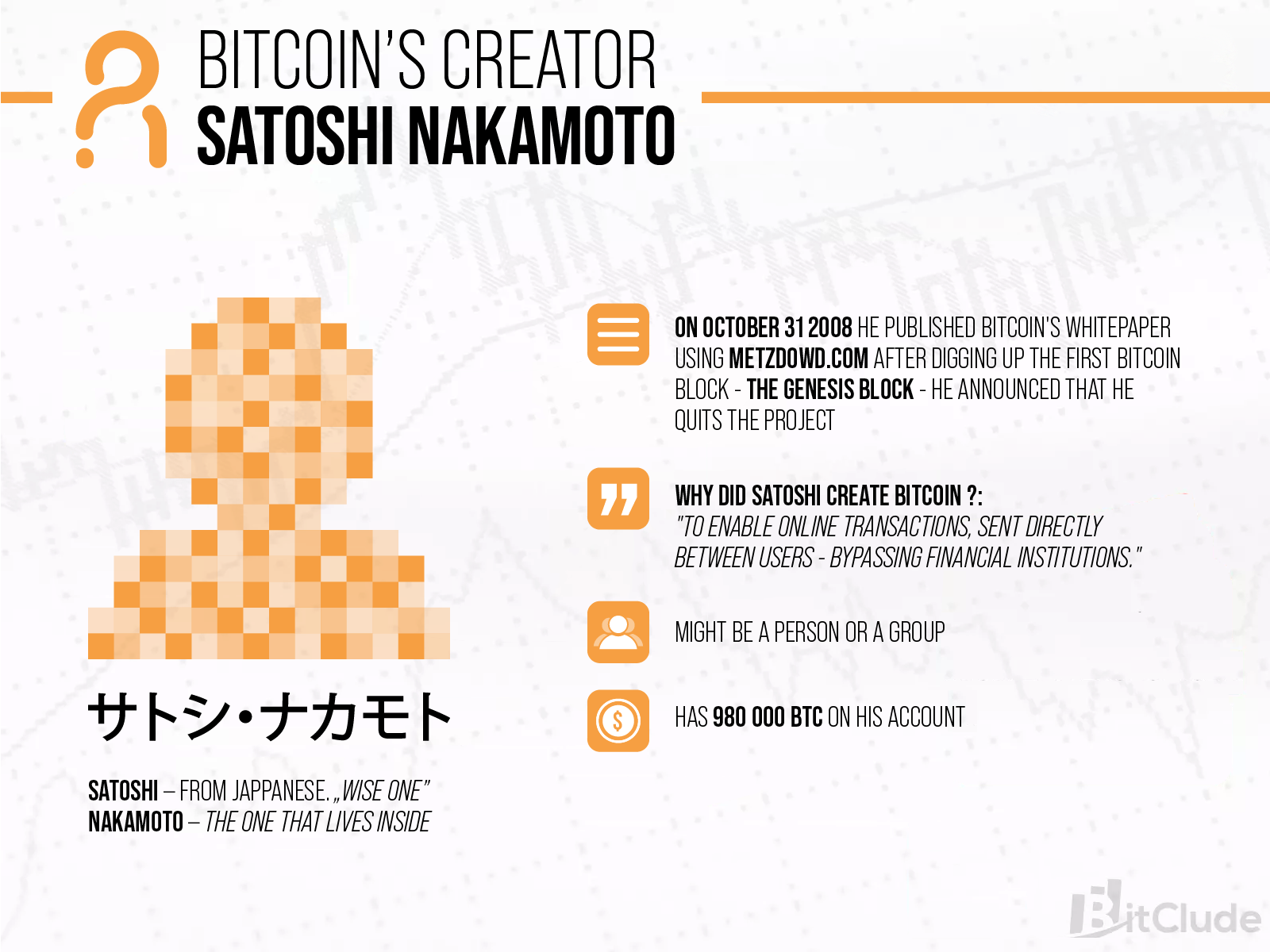

Satoshi Nakamoto - Creator of Bitcoin

The creator (or creators) of bitcoin is considered to be the person (or group of persons) who use the pseudonym Satoshi Nakamoto.

To this day, it is not known exactly who Satoshi Nakamoto is. All that is known about him is that he was a member of the metzdowd.com mailing list. It was through this list that Nakamoto published the Bitcoin Whitepaper on 31 October 2008. At the same time he explained the mechanism of blockchain algorithms.

Unfortunately, shortly after digging up the first bitcoin block - the Genesis block - Satoshi Nakamoto, via a crypto community forum, announced his exit from the project, while assuring that bitcoin remains in good hands. Since that post, hearing of the Bitcoin creator has been lost.

Why Bitcoin

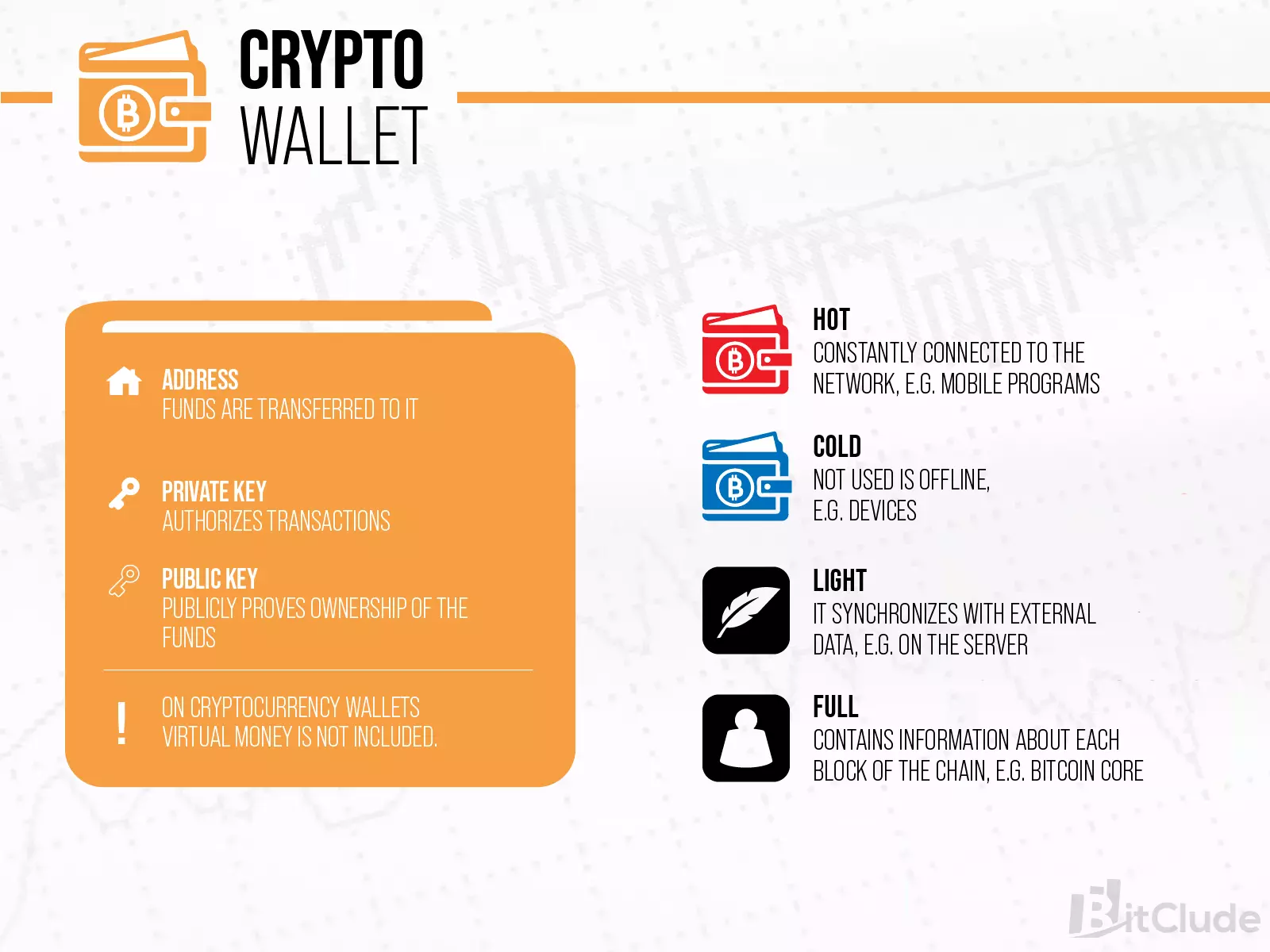

Despite appearances, cryptocurrency wallets do not hold virtual money.

Wallets are used by users to store information about assets, including their location across the chain. It can be said that a bitcoin wallet is a kind of intermediary between the user and the Blockchain network. Specifically, such a wallet does not hold bitcoin, but it does hold:

- Address: The address is processed by complex operations and part of it is the public key (SHA-256 algorithm). Its length is 160 bits. Transfers of funds are made to this address. If necessary, another address can always be generated;

- Private key: Each private key is unique and generated completely randomly. The key is used to authorise cryptocurrency transactions. The security of such a key is highly important as its loss is linked to the irretrievable loss of accumulated btc;

- Public key: It has a length of 256 bits and is generated from the private key. In theory, it is possible to obtain a private key from a public key. However, in practice such theft is practically impossible. This is because in order to gain access to the private key through the public key a huge computing power is needed, and such a power currently does not have even the latest supercomputers.

| Statistics | Value |

|---|---|

| Current price | |

| 24h change | |

| Highest value of the last 24 hours | |

| Lowest value in the last 24 hours | |

| Highest historical value (ATH) |

Cold and hot bitcoin wallets.

When looking for information on Bitcoin wallets you may come across terms such as: Hot Wallet and Cold Wallet. However, don't be taken in by their name as it has nothing to do with temperature.

These two concepts represent two methods of storing virtual currency.

A Hot Wallet is a digital wallet with a permanent connection to the network. A Cold Wallet, on the other hand, is a hardware wallet usually in the form of a separate device similar in appearance to a popular flash drive. Choosing the right bitcoin wallet may not be that simple as there are many elements that differ between wallet types.

Types of wallets used to store bitcoin information:

There are currently several types of wallets for storing cryptocurrencies. Choosing the right one requires familiarity with their characteristics. We can divide wallets into two basic groups - the previously mentioned hot and cold wallets, and many subgroups such as:

Zimne Bitcoin wallets.

Cold wallets are characterised by being permanently offline - a connection is only necessary to transfer funds. Using them is extremely simple. They are available as a completely separate device. Hardware wallets look like a pendrive and also require a cable to connect to a computer. All you have to do is plug such a device into your computer and enter your password. This is one of the best options for long-term bitcoin storage.

Features of the cold wallets page.

Advantages of cold wallets:

- Collections of information about a given cryptocurrency are stored on a separate device that can be disconnected from the network. Storing data off the network makes the device little vulnerable to external attacks, making them the safest form of bitcoin storage;

- In case of loss of the device it is possible to recover the funds. This is done using a specially generated seed;

- The devices have dedicated software that is optimised for storing hundreds of different cryptocurrencies.

Disadvantages of cold wallets:

- One of the big disadvantages of the equipment is its relatively high price. Beginning investors do not use hardware wallets, their price (starting from about 250 - 300 PLN) is often prohibitive and an unnecessary expense. However, it is important to compare the price with safety. Hardware wallets are worth investing in, although they will be more necessary for investors with significant amounts in their portfolio;

- As it is a separate device, of course you can forget about it. It is necessary to carry it with you - to be able to make transactions with virtual currency;

- The device can be stolen or lost;

- Hardware cryptocurrency wallets support a strictly limited number of different cryptocurrencies. Before buying a device, you should carefully check which virtual currencies it supports and only then decide on the purchase.

Bitcoin wallet - a piece of paper.

An alternative to cold and hot wallets is a paper cryptocurrency wallet. It is less convenient to use than hardware wallets and hot wallets. Nevertheless, it features a very high level of security.

Creating a paper wallet is quick and easy. Simply generate your private key and public key and then print them out on a piece of paper. A good solution is to download a wallet that works offline. As mentioned above this is in a sense a safe. This solution is only good if the account is to be used for storage purposes. No transactions can be made offline.

Hot Bitcoin wallets.

Hot wallets are characterised by a constant connection to the network. Compared to cold wallets, hot wallets are characterised by a slightly lower level of security as they are continuously vulnerable to hackers, and rely on external entities and their servers.

Features of hot wallets.

Advantages of hot wallets:

- The main advantage of hot wallets is convenience. There is no need to carry the device with you. They are mobile, allow quick transactions and easy access;

- If a person using a hot wallet notices a problem with its functioning they can report bugs. This has an impact on the continuous improvement of this type of wallets;

- It is possible to verify the degree of security, as many such wallets are open source;

- For the most part, hot wallets are free;

- You can store information about even little-known cryptocurrencies on them;

Staying online hot wallets are both an advantage and a disadvantage. On the one hand, they provide users with mobility, but on the other, they lose out on security.

Disadvantages of hot wallets:

- easy access and exposure to hacking attacks;

- They may have technical interruptions and limited access at the same time.

Wallet on mobile and desktop app:

The first of its kind, are wallets in the form of a mobile application, which can be installed on mobile devices. They are the most convenient form of storing cryptocurrencies - the bitcoin wallet, along with the phone - we always have with us! Unfortunately, by belonging to the type of hot wallets, the mobile application is always online, which makes it vulnerable to external attacks. An example of a mobile wallet for Android is GreenBits.

When it comes to desktop wallets, there are two types to choose from - full and lightweight.

Full cryptocurrency wallets fully synchronise with the entire blockchain, meaning that it downloads the data of the entire blockchain to the computer's local disk. Synchronisation involves a long wait time, which has frightened novice cryptocurrency enthusiasts more than once. Full wallets are recommended for more advanced BTC users.

Lightweight wallets use information stored in the cloud, so they take much less time to sync and use less computer memory resources.

Browser wallets:

No additional devices or downloaded apps are needed to use such wallets. All you need is a device that has a web browser installed. This is the highest level of mobility for cryptocurrency wallets. The disadvantage of browser-based wallets is the low level of security. It is best and most prudent to use this type of wallets on a short-term basis.

Cryptocurrency exchanges

Cryptocurrency exchanges are places where users can buy cryptocurrencies. More recently, cryptocurrency exchanges have adapted auctions and regular NFT sales to their business. Without cryptocurrency exchanges, trading in digital assets would be very difficult. Exchanges are generally divided into two types:

Decentralised exchange (DEX) and centralised exchanges:

A decentralised exchange (DEX) is a type of exchange that, according to the philosophy of cryptocurrencies, is without a central entity. Transactions on such an exchange are carried out directly between users, i.e. in a peer-to-peer (P2P) model. Decentralisation helps to maintain the integrity of the exchange and prevents trade rigging and price manipulation.

Centralised exchanges are like banks in the way they operate. We are dealing with an overarching authority that controls users' transactions. The overarching authority on the cryptocurrency exchange maintains order and security of transactions. Users of centralised exchanges surrender control of their funds to the exchange, thus losing the privilege of holding 100% control over their funds.

The undoubted advantage of centralised exchanges is simplicity of use - the client does not have to remember about public and private keys - he does not even have to store them, this is taken care of by a centralised master entity.

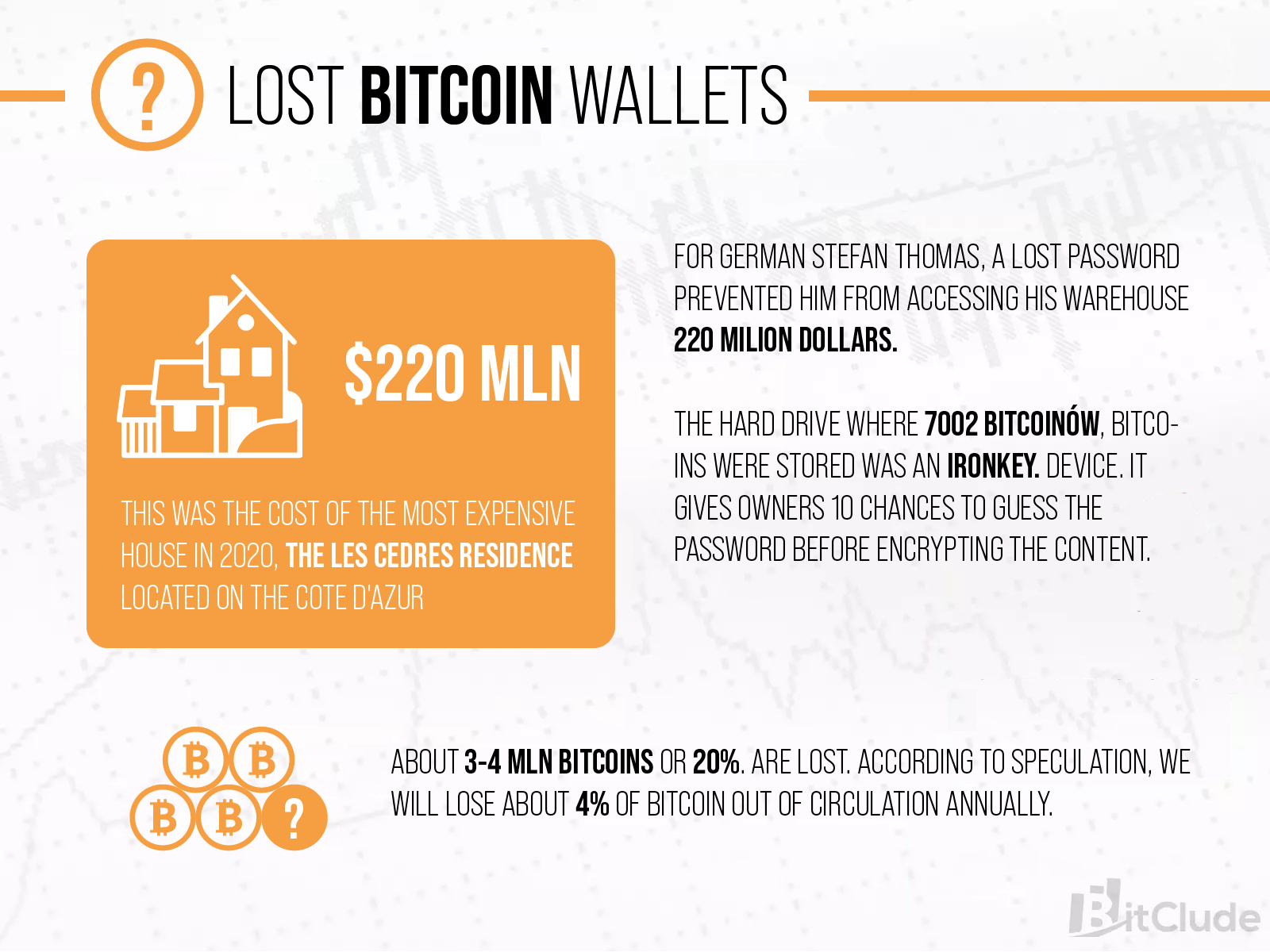

Lost Bitcoin Wallets

There are times when users lose their cryptocurrency wallets. Unfortunately, this is a fairly common occurrence. The most common cause of losing keys and access to the wallet is a change of device or drives, but also the loss (e.g. lost) of hardware wallet. Around the world you can find news about the loss of a wallet where the value of bitcoin equals to winning a huge lottery.

Most cases are caused by the inattention of wallet owners themselves. The number of ghost bitcoins is very difficult to estimate, although experts point to the irretrievable loss of around 20% of dug-up bitcoins.

The superb security of the mixing algorithms behind bitcoin's security makes it extremely likely that lost bitcoins will never be recovered again - they will forever remain in nomenclature as Phantom Bitcoins.

- The private key should only be known to the wallet owner. It should not be shared - its loss or leakage will result in loss of control over funds;

- If you own different cryptocurrencies it is worth keeping them in different wallets. This will ensure the protection of at least part of the funds in the moment of losing the private key;

- If you do not plan to conduct bitcoin transactions it is worth storing them offline;

- If possible, it is recommended to generate a seed to recover the private key;

- Make sure your computer is virus-free and protected against hacker attacks.

Bitcoin's price and value

The exchange rate of cryptocurrencies is very dynamic, but it is worth remembering that it is the exchange rate of bitcoin that has reached the highest values since the beginning of the era of digital currencies. Unlike fiat currencies, the price of bitcoin is highly volatile, although it continues to rise and is not subject to inflation over the long term.

There are currently 18 million btc in circulation (target is 21 million). As I mentioned, it is estimated that all Bitcoins will be mined by 2140, which could significantly change the way this cryptocurrency works - how miners will behave in this situation - we will find out in only

120 years.

Bitcoin's price is due to its acceptance by a huge range of users and technology development businesses. Silicon Valley, although initially sceptical, is increasingly willing to adopt blockchain solutions, but also Bitcoin itself.

The huge demand means that Bitcoin may (but doesn't have to) break another price record and, with a little help from a dedicated community, could ultimately contribute to the revolution of traditional currencies.

What factors influence the price of Bitcoin?

What then happens to bitcoin if the strength of the economy is not the factor responsible for the rise or fall in its value? Two factors are really key - the interest in investing in bitcoin and the number of transactions currently taking place in the market. Increasing supply leads to a decrease in the price of bitcoin, while greater demand with less supply causes the price to rise.

The reality, however, is a little more complicated and those wondering what will happen to bitcoin in 2020 have had the opportunity to see that it is not such an immune currency to global crises. Other factors influencing the price of bitcoin include:

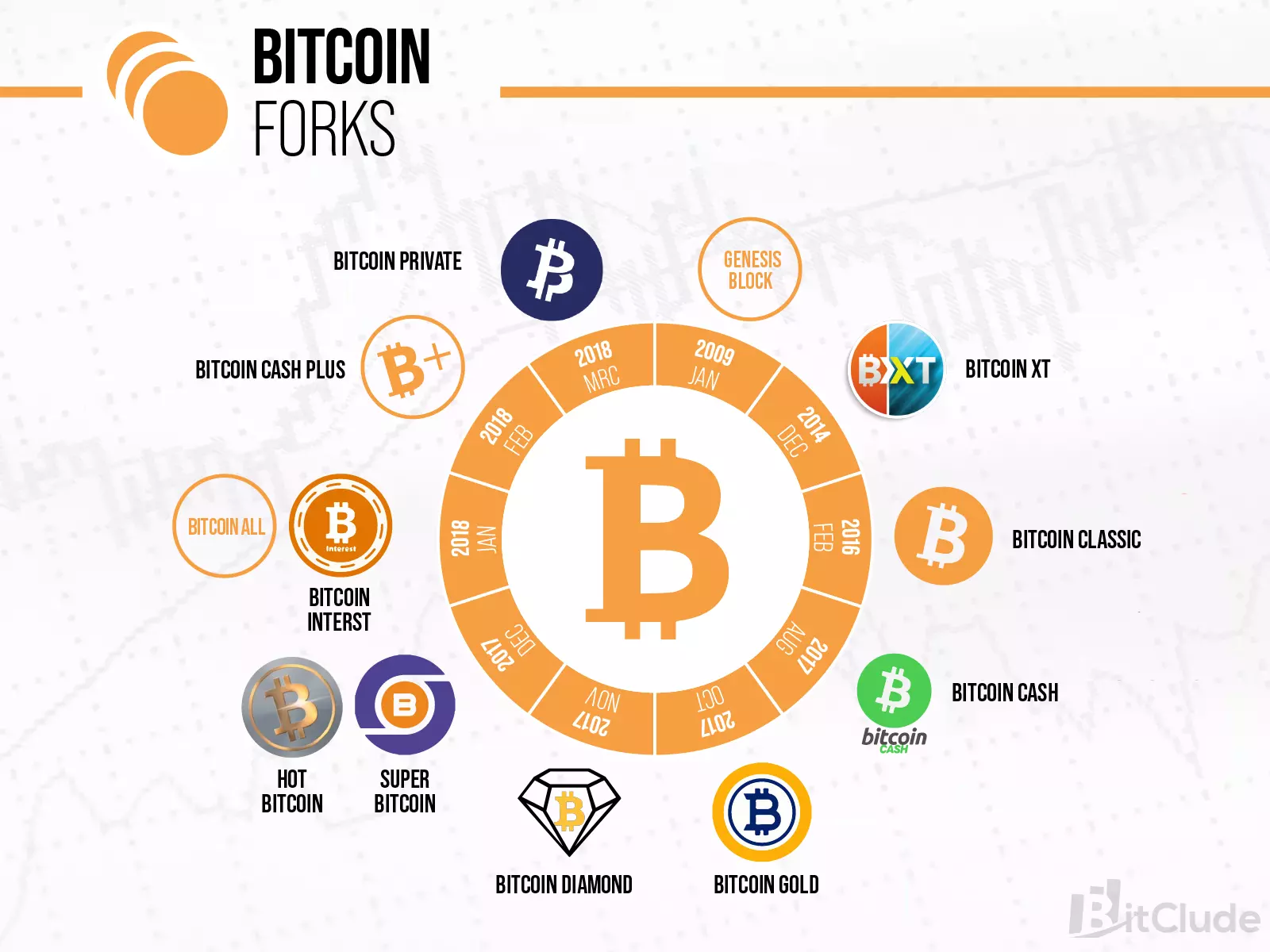

- Forks, a situation in which a chain of blocks is split or branched;

- Potential regulation - those wondering what's next for bitcoin are also considering the possibility that regulation may come in the next few years that hasn't been there before;

- Media - the price of bitcoin is also influenced by current public opinion, the potential for future use of blockchain technology, the fact that the number of available bitcoins is finite (21 million) and that digging them up will likely end by 2140.

The future of Bitcoin

Bitcoin will not change its form - it will always be the first cryptocurrency to launch a new era of payments. Along with the nimbus of primacy, it also carries the burden of sub-optimal solutions and negligible payment value - transactions in Bitcoin have always been and will continue to be the asset's biggest Achilles heel - the currency has a low transaction rate per second, and horrendously high commissions when network congestion is higher.

What is the future for Bitcoin? It will probably be adapted as a means of payment (because it is the most well-known), although it will not be the final solution for transactions. Bitcoin most often acts as a store of value, and its positive properties in this regard are compared to gold.

You can watch the bitcoin exchange rate and speculate on the profits you will make by investing, but at Egera you can turn observation into real action!

Can bitcoin replace other currencies?

You know what cryptocurrencies are and you see how much interest there is in the subject - so you may wonder if bitcoin is capable of replacing other, traditional currencies. Even serious financial institutions have started to take cryptocurrencies seriously, but it is difficult to give a clear answer to this question. Instead, there are countries that are working on creating local cryptocurrencies, considering them as an opportunity to reduce transaction costs and make them more secure. Some experts predict that bitcoin will have a function similar to gold, serving as a hedge in case of a black scenario.

How to pay with bitcoin?

Wondering how you can pay with bitcoin for a service or product? The adaptation of bitcoin is still ongoing, but more and more places are accepting payments with it. But how do you do it? All you really need is a wallet app or QR code scanner, and then the transaction is similar to standard transactions. If you're making a payment online, such as on a shop's website, you don't have to worry about how to do it, as companies usually provide their customers with guidance. Of course, you can also use a cryptocurrency exchange and exchange bitcoin for another currency. What can you buy with bitcoins? More and more products and services - from goods in online shops to buying real estate or paying for private medical services.

How to start investing in bitcoin?

You already have a basic knowledge of what bitcoins are, and it is essential to invest in cryptocurrencies. It is worth keeping up to date and educating yourself so that your investment is fully informed - you can count on our help in this matter as well. For most people it is still not obvious how bitcoin works and what you can buy with bitcoins, so act responsibly for the sake of safety. You can find up-to-date information about cryptocurrencies on our website.

Meet Egera - our bitcoin platform that allows you to verify your data instantly, and withdraw funds quickly when you need it. Feel free to invest with our help!

FAQ

What is Bitcoin?Bitcoin is a cryptocurrency, a digital currency that is not controlled by a central bank or any other financial institution. Bitcoin is decentralized, which means there is no single owner, administrator, or manager. The power over this cryptocurrency is in the hands of Bitcoin users and holders.

Who is the creator of Bitcoin?The person who created Bitcoin is Satoshi Nakamoto. It is not known who Satoshi is exactly - it is not even known whether the pseudonym refers to one person or a group of people.

How to buy Bitcoin?Bitcoin can be bought on cryptocurrency exchanges and currency exchange offices, such as Egera. It is enough to create an account on such a trading platform, verify your identity, deposit funds, and then exchange them for an available cryptocurrency - for example, Bitcoin.

Is Bitcoin safe?Bitcoin is secured by very strong cryptographic tools - including the SHA-256 hashing algorithm, which has not been broken so far. Transactions in the Bitcoin network - although public - are also completely secure. The critical element of Bitcoin security is the user, whose carelessness can lead to the theft of private keys, and as a result, the loss of owned cryptocurrencies.

Is it worth investing in Bitcoin?Investing in Bitcoin is risky and should be a carefully considered decision. Bitcoin is a virtual currency and is characterized by large fluctuations in value, which are very rarely seen on traditional stock and currency markets. Before making a decision to invest in Bitcoin, a thorough risk analysis and assessment of potential profits should be conducted.

Table of Contents