Egera - Bitcoin exchange and secure cryptocurrency exchange

Blockchain is a decentralised system, called a chain of blocks, which is used to store and transfer information. This is the short definition of blockchain technology. For people beginning their adventure with the world of cryptocurrencies and blockchain technology, this definition does not say much. In order to understand the essence of this technology, it is necessary to delve a little deeper into the subject and understand what are the characteristic features that make this technology considered revolutionary. What is blockchain and what is its significance for the future of finance (and even the entire economy), you will learn from this article.

Before we go on to explain what blockchain is used for and how it works in practice, let us first try to consider what the term means from a dry almost bookish definition. Blockchain, in Polish referred to as a chain of blocks, sometimes also as blockchain. It is an architecture for storing information in a way that ensures immutability of historical data. By definition, it is a decentralised and distributed register on a network infrastructure.

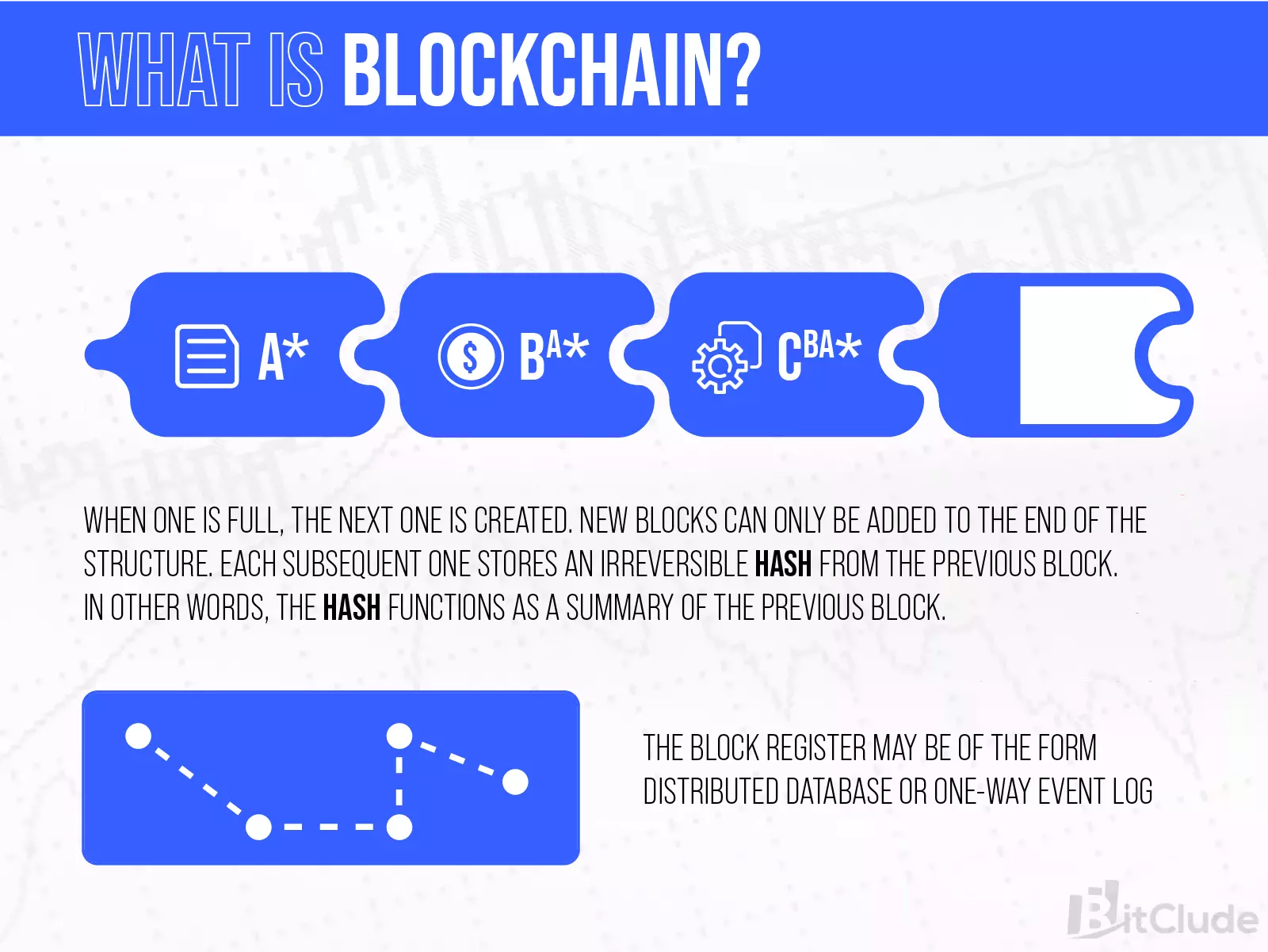

A block register may be a distributed database or a one-way event register. In such a register, new blocks can only be added at the end of the block structure.

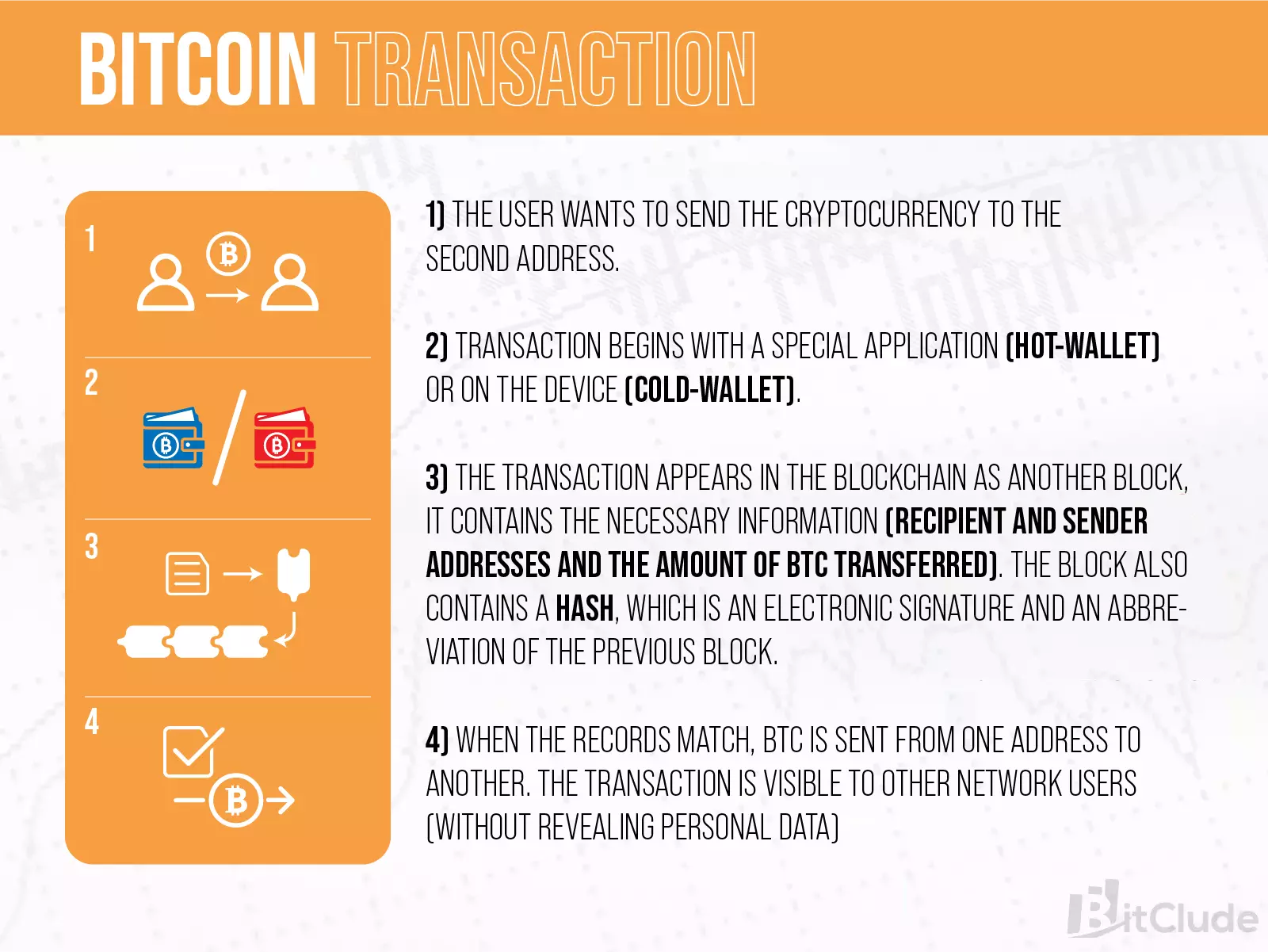

Approaching the subject from a practical rather than a theoretical definition, we can say that blockchain is a digital ledger that acts as a register of transactions. Most often, the register concerns data in the form of financial transactions. The simplest examples are transactions involving cryptocurrencies, shares, stocks or electricity.

The essence is based on the fact that each subsequent block stores an irreversible hash storing information from the previous block. In other words, the hash functions as a summary of the previous block.

One of the characteristic pieces of information next to the hash is the timestamp, which is the information about when a specific block was created. As a result, the hash and timestamp ensure that blocks are tightly coupled and it is impossible to tamper with the blockchain unnoticed.

It is worth noting that each block stores a certain amount of data (e.g. in the form of a certain number of financial transactions). When one block is full then another block is created which follows.

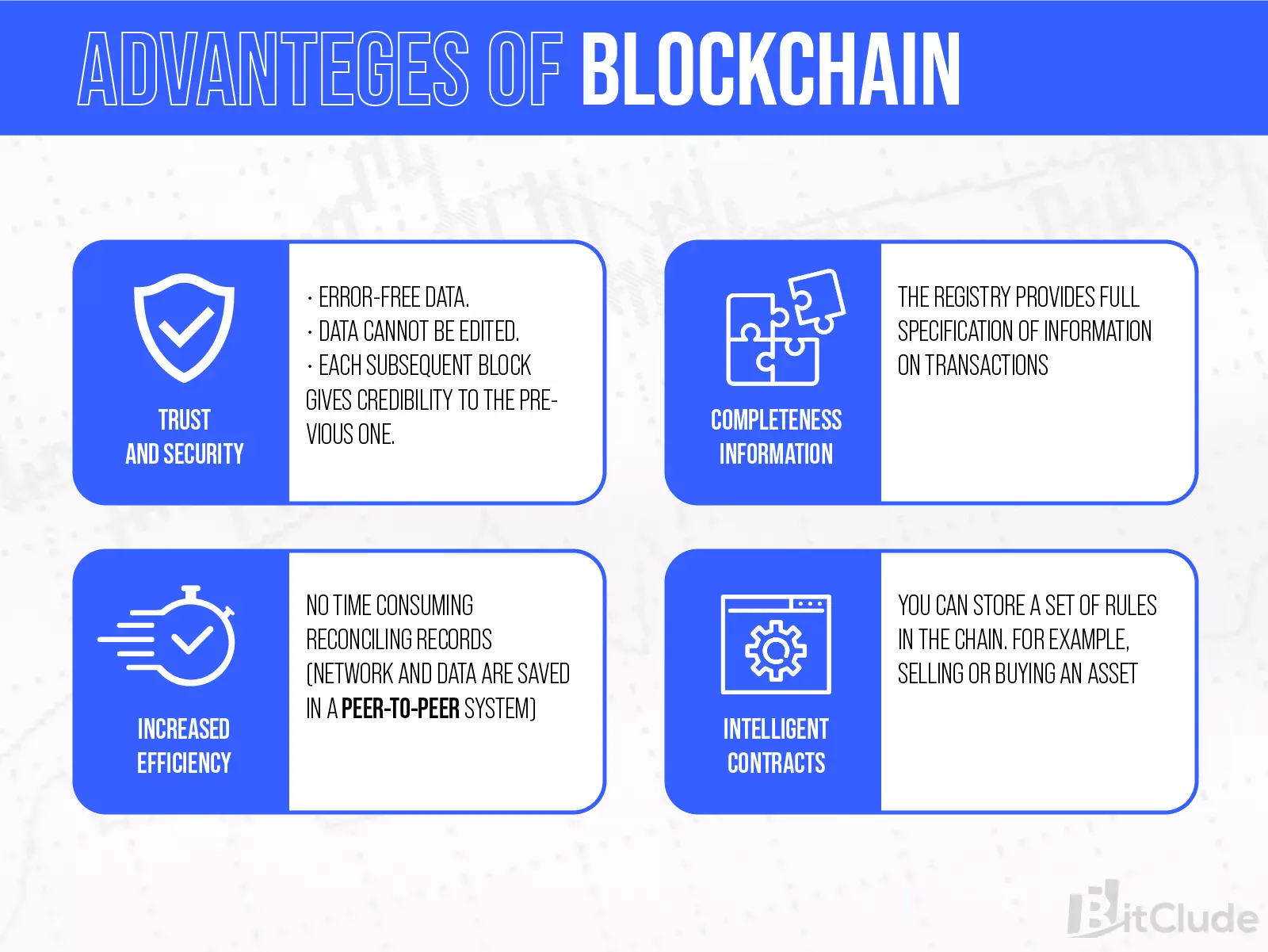

Decentralisation is a characteristic feature. No central database, one main server, computer or any other technical infrastructure is needed for the system to function properly. Stored data is stored only in consecutive blocks. This means that transactions are distributed on a peer-to-peer basis. This is very important as it means in practice that transactions are not monitored by a central intermediary (although they are public).

This makes blockchain considered a very good information medium, as it is a common and completely transparent access to uneditable data. The data is transparent and reliable for all users which promotes trust, security and development. More specifically, blockchain provides privacy, but this must not be confused with anonymity. Addresses are public, which means that, although personal details are not known, something like an 'account number on the blockchain' is public and everyone can see the transaction history.

Speaking about blockchain network, one cannot pass by indifferently touching the subject of security. Securing the transaction register in blockchain technology uses advanced cryptographic algorithms which protect against data editing and unauthorised access. Breaking cryptography is possible in theory, but in practice you need a computer with huge computing power.

Interestingly, for entertainment and scientific

purposes, it was calculated that a computer with the power of... half of all Internet users would be needed. Whatever such a calculation means, the conclusion is one - huge computing power is needed and there is no real threat of hacking into blockchain networks. Nevertheless, there are some rumours that the security problem may return when quantum computers become available. However, this is not something that is currently bothering security professionals. The problem

arising from quantum computers is more a melody of the future.

From a security perspective, the characteristics of blockchain technology make it a solution that favours increased data security. Practice shows that it is much more difficult to falsify transactions. Firstly, it is not possible to modify transactions (once a transaction is posted, it stays that way), and secondly, the transaction history is transparent to everyone. This makes blockchain technology considered to be a safe and reliable method of storing information.

As a summary, we briefly list the benefits specific to blockchain technology:

The history of blockchain technology is now 20 years old.

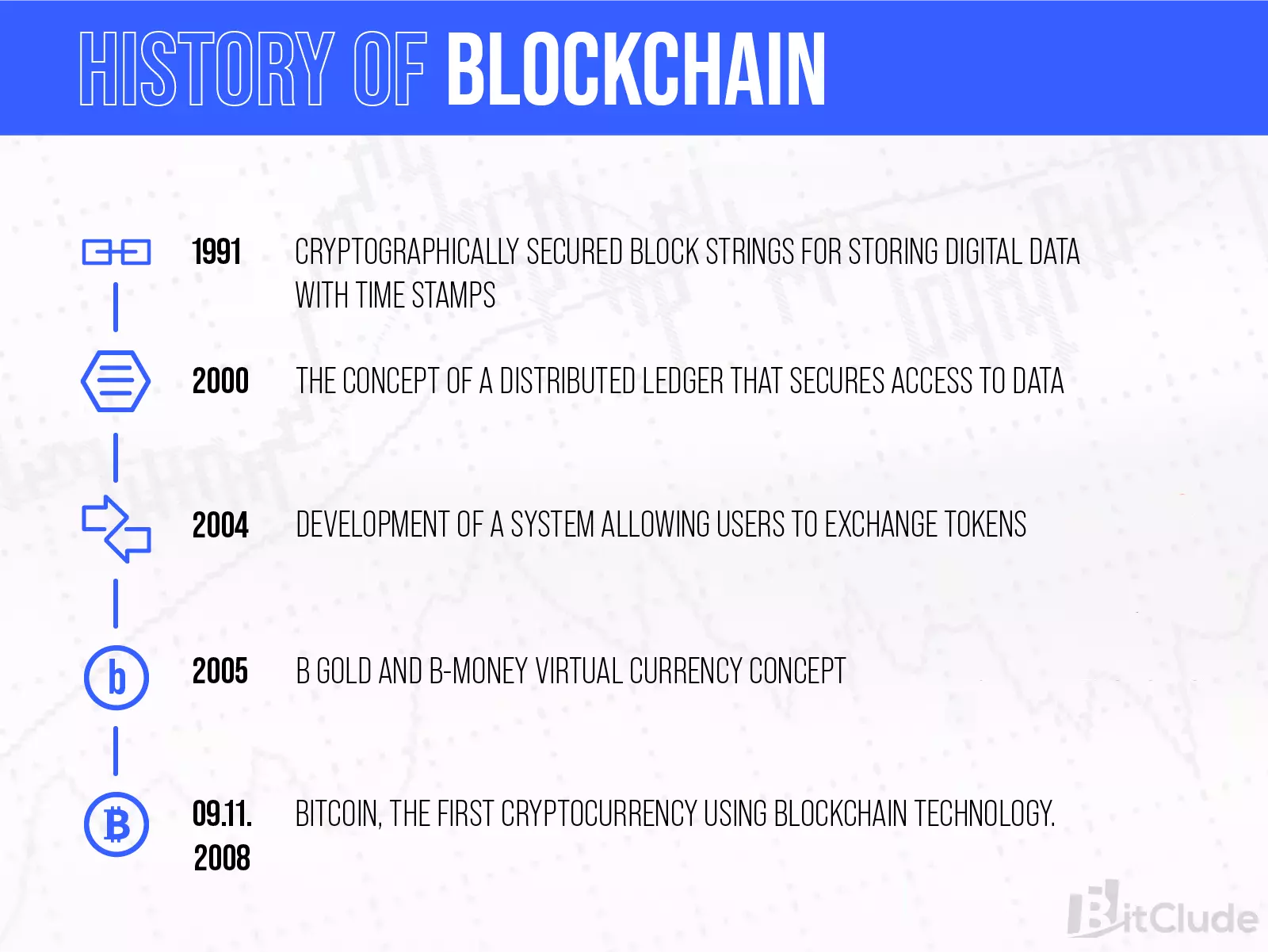

Blockchain is an issue that is currently very much in the news and is regarded as a technology of the future. However, it is important to note that the history of blockchain is longer than it may seem. The first mention of this type of technology was in 1991.

In that case, the system used cryptographically secured strings of blocks to store digital documents with time stamps. Subsequent dates in the development of blockchain technology include 2000 (concept of a distributed ledger that secures access to financial data), 2004 (development of a system that allows token exchange between users), 2005-2006 (concept of a virtual currency called B Gold and b-money).

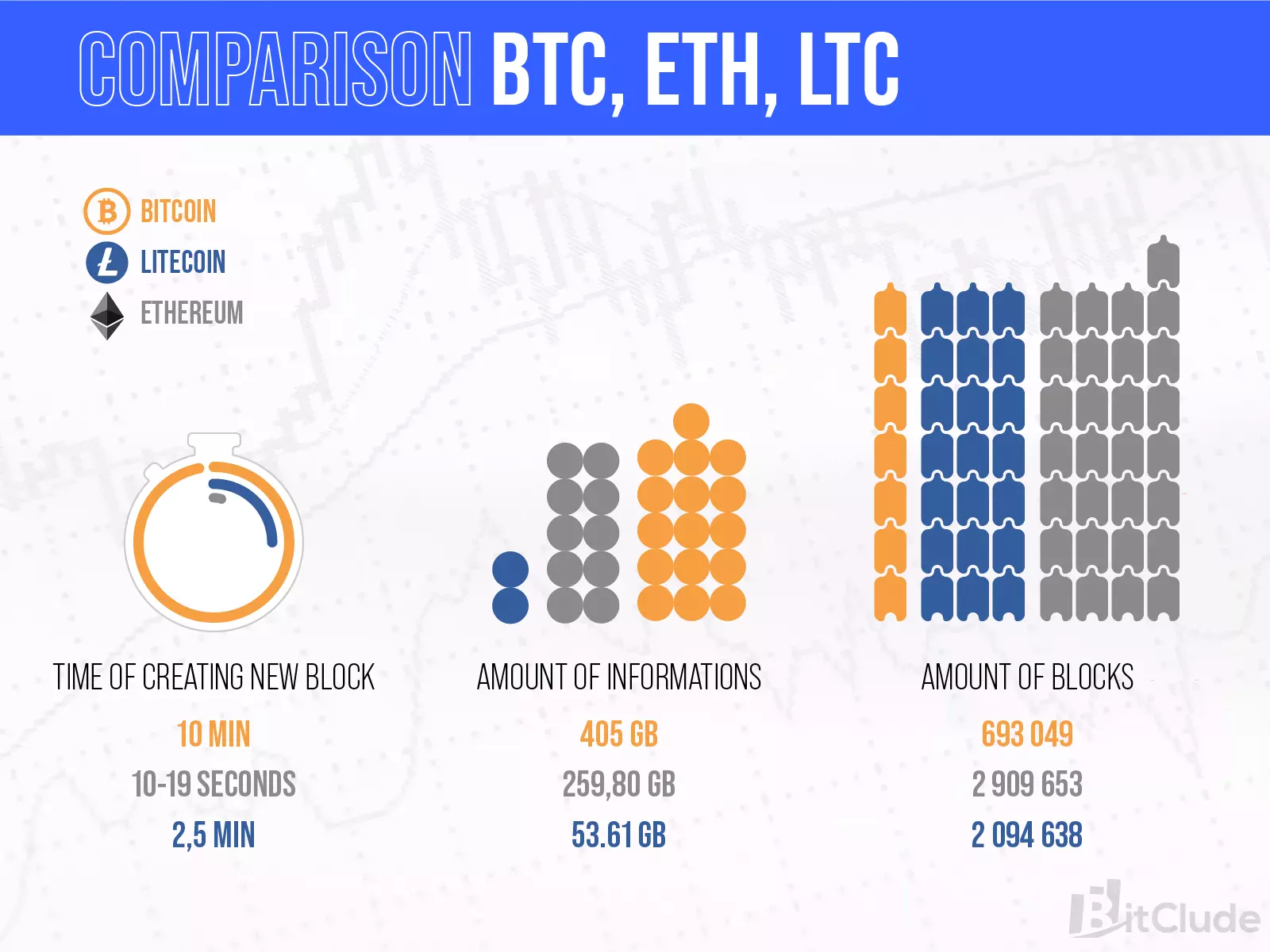

All these dates preceded the landmark moment that is November 9, 2008. It was then that a cryptocurrency using blockchain technology was made public. This cryptocurrency was, of course, Bitcoin. Currently, there are, as we know, many more similar projects. Apart from Bitcoin, especially popular is Etherium, which is based on the so-called blockchain 2.0. Ethereum's breakthrough lies in the fact that it is possible to run code (called smart contract) in consecutive blocks.

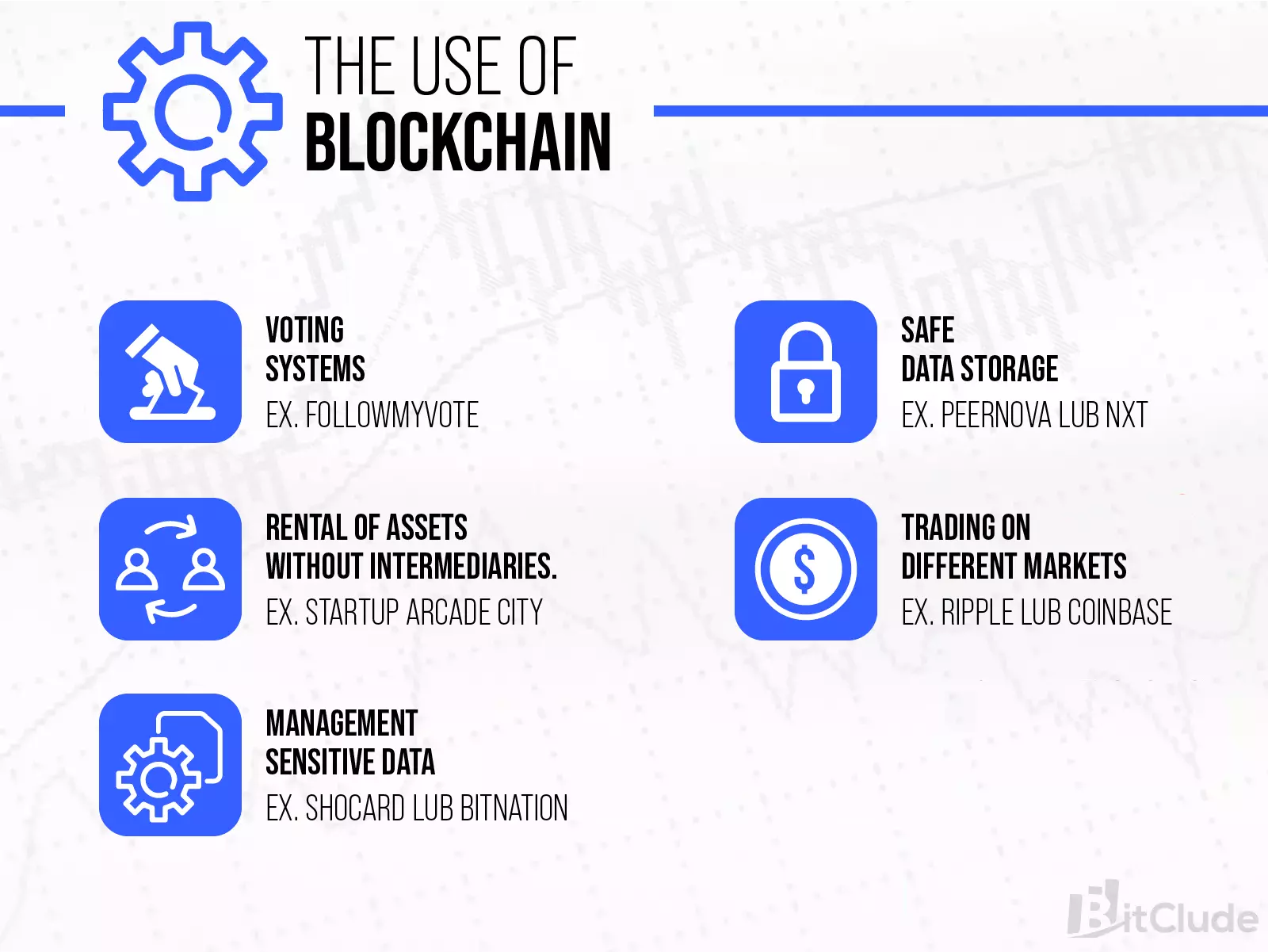

As a rule, blockchain is associated or even identified with cryptocurrencies, but it is worth knowing that the scope of use of this technology is much wider and cryptocurrencies are just the tip of the iceberg. In addition to the widely understood technology and financial industry, we can meet this technology in public administration or the energy sector. Examples of the use of blockchain beyond cryptocurrencies are listed below.

The applications are very wide, but there is no denying that it was cryptocurrencies that made blockchain come out of the shadows and today people who have little to do with cryptography are interested in such an issue. A large group of people even equate blockchain technology with cryptocurrencies.

This is not a big mistake, because as we know cryptocurrencies use blockchain technology. However, it is important to keep in mind that bitcoin, cryptocurrencies and blockchain are different (and not the same) concepts. Bitcoin is a cryptocurrency in which transactions are made in a decentralised manner and are recorded in a peer-to-peer system (between users) using blockchain.

Transactions executed on the blockchain are irreversible because all transactions are recorded on the blockchain, with no possibility to change transaction information (irreversibility of the transaction ledger).

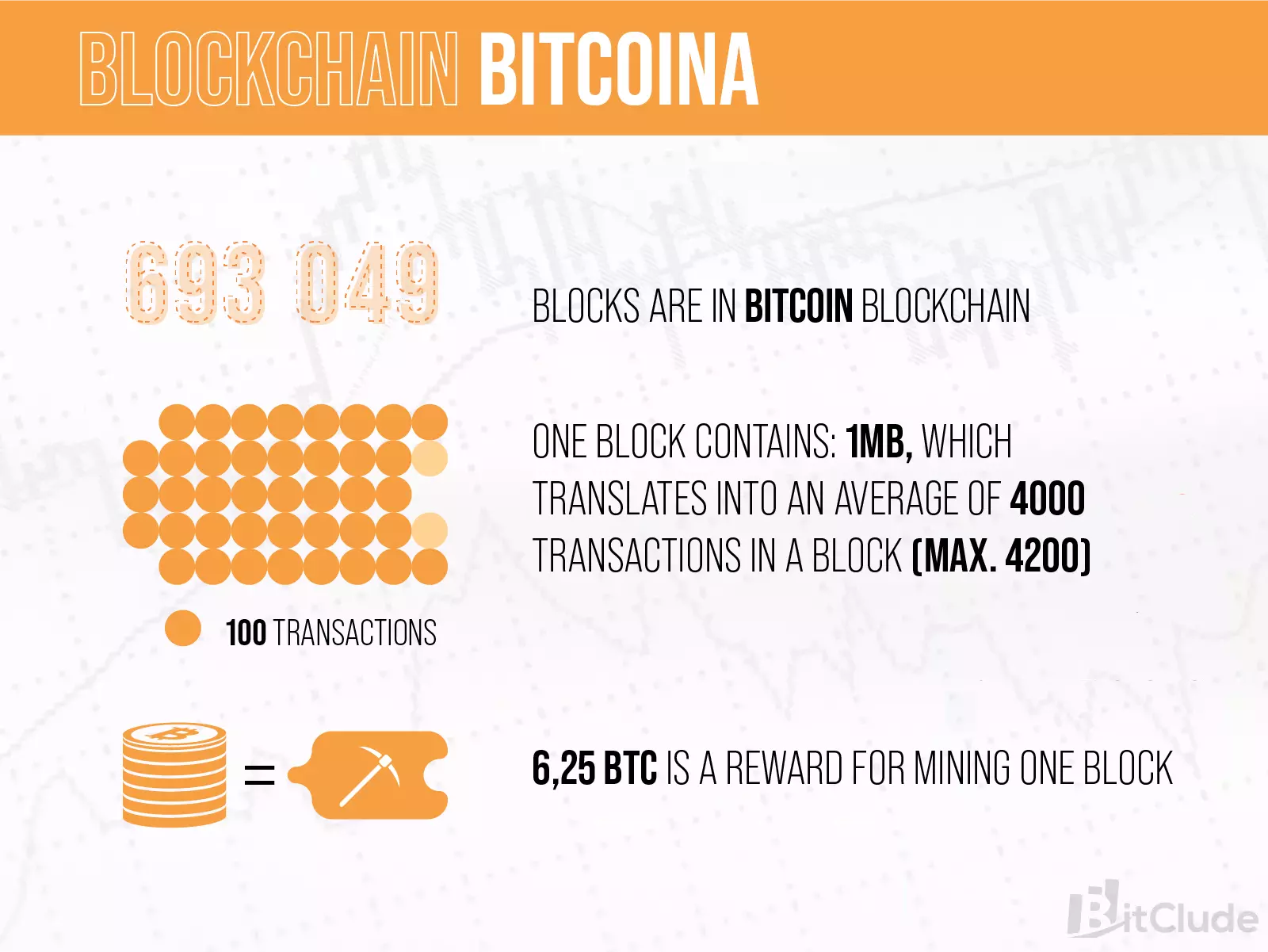

A very fascinating topic is cryptocurrency mining. For many people it sounds very futuristic and not understandable. However, once we learn the basic information about how blockchain technology works, the cryptocurrency mining itself becomes greatly illuminated. When a user makes a transaction using cryptocurrency then other computers (of other users) verify such transaction and thus enable the transaction.

To put it simply, computing power is required (advanced mathematical operations are performed to verify transactions). Users who provide a bit more computing power as a reward receive a portion of the cryptocurrency, which is commonly referred to as cryptocurrency mining.

The question arises as to whether using cryptocurrency will still be possible after the last BTC has been dug up? Firstly, this is still a long way off, as the last bitcoin will not be dug up until 2140. However, it is estimated that at that time cryptocurrency miners will still be needed to keep the network flowing. Except that they will have to accept that they will not be rewarded for mining new blocks.

Will this cause liquidity problems?

On the surface, it seems that this could be the case, but according to many scientific theories, the future of BTC could be just the opposite. By 2140 the network of people using cryptocurrencies may be so large that BTC and other currencies may serve as a very liquid means of payment even if it is not possible to mine further blocks. Either way, these are some predictions and speculations.

Meanwhile, no one can predict what the future holds for BTC and other cryptocurrencies. Discussing what will happen to Bitcoin in over 100 years is something that not everyone is particularly interested in.

A look at the near future of cryptocurrencies is something that cannot be passed by. Cryptocurrencies are identified as an alternative to the current monetary system. Interest in cryptocurrencies continues to grow.

Apart from individual investors who see them as a way to store the value of money over time, FinTechs, institutions and government organisations should be mentioned. Major corporations such as PayPal, Microsoft and banking institutions (Citibank) make no secret of their interest in cryptocurrencies.

Recently, there has been a lot of talk about Elon Musk looking at cryptocurrencies with a favourable eye, along with many other well-known figures from the top of the global financial community. In addition to this, it should be noted that it is increasingly common to hear reports that the governments of certain countries will see a future in cryptocurrencies.

Either way, the future of Bitocoin and other cryptocurrencies is material for a discussion that will never end. The voices for and against digital currencies are countless. We certainly don't know the future, but we must admit that cryptocurrencies are well on their way to being a disruptive asset that could have a revolutionary impact on the state of global finance.

What raises concerns for some enthusiasts of blockchain technology is its legal status. The Polish government has not issued a clear decision regarding the regulation of cryptocurrencies and blockchain technology. Although, of course, this does not mean that this topic is not noticed by the government and public administration (if only because of the fact that one can encounter tax interpretations on accounting for revenues from cryptocurrencies).

It is worth noting that many start-ups using blockchain operate at a global level. The approach of governments sometimes varies. A particular example is the Chinese and Venezuelan jurisdictions where cryptocurrencies are banned. In contrast, Malta and Estonia, which are known for their friendly approach to blockchain technology, are in opposition. It is in these countries, among others, that many fintechs geared towards using blockchain in their operations are located.

The growing interest in blockchain technology has an impact on global economic development. Various types of projects on the borderline of the technological and financial sector, known as FinTech, are seen as a kind of engine for the economy.

There are many voices that unequivocally stress that the development of the blockchain industry is beneficial from an entrepreneurial perspective and from the perspective of the economy as a whole. The current conjuncture favours the development of blockchain technology.

Governments, institutions and entrepreneurs are keen to invest in the development of various blockchain-based technologies. The result is the development of hundreds, start-ups that receive funding for development and research. The list of applications that can be found on the blockchain is very long, but we can risk a thesis that this is just the beginning.

The huge interest in this technology and the large funds that are being invested in further research allow us to believe that a technological revolution based on blockchain is still to come. Interestingly, this is confirmed by The World Economic Forum (WEF), which places blockchain technology among the cornerstones of the digital finance market.

This prestigious group also includes artificial intelligence (AI), mobile platforms and the Internet of Things (IoT). In a report published by the WEF, it is crypto-based technology that is seen as one of the cornerstones of sustainable development policy.

In conclusion, it is important to emphasise what the OECD notes, namely that the revolutionary approach to data storage that blockchain technology offers can drive the systemic changes needed to provide sustainable infrastructure. In other words, we are living in a time when blockchain technology is at a point of intense development and there are many indications that not only the FinTech industry but the economy as a whole can benefit.

Table of Contents